(Quratulain Khalid)

Introduction: A Geopolitical Ambush

On August 6, 2025, U.S. President Donald Trump doubled tariffs on Indian exports to 50%, citing India’s obstinate purchase of 35% of its crude oil from Russia, a move he claims fuels Moscow’s war in Ukraine. For instance, Trump’s Truth Social post accused India of profiting from oil resales, ignoring the deaths of Ukrainians. India’s Prime Minister Narendra Modi, displaying overconfident defiance, vowed to prioritize energy security for 1.4 billion people, dismissing the tariffs as “unfair, unjustified, and unreasonable.” Consequently, this standoff, one of the lowest ebbs in U.S.-India relations, poses critical questions: Can India outsmart Trump’s 50% tariffs over Russian oil? What are its options, and what risks does its arrogance carry? Will it recklessly pivot to China and Russia, alienating the West? This article explores India’s strategic missteps, economic vulnerabilities, diplomatic options, and the precarious path ahead, highlighting the folly of its current posturing.

Historical Context: India’s Trade and Geopolitical Miscalculations

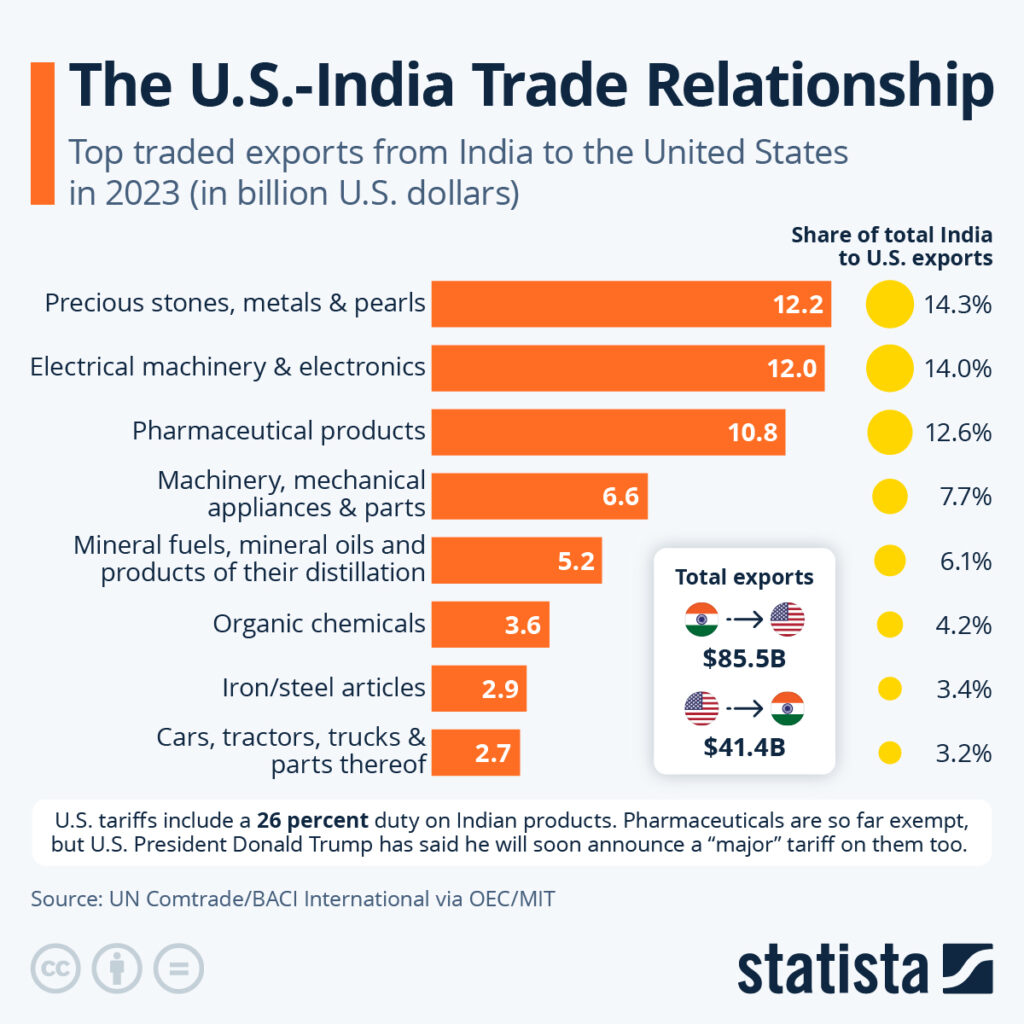

India’s trade relations with the U.S. have long been marred by its protectionist instincts and diplomatic overreach. For example, post-1991 reforms boosted bilateral trade from $5.6 billion in 1990 to $131.8 billion by 2024, with India’s $44.4 billion trade surplus driven by textiles and pharmaceuticals. Yet, India’s 12% average tariffs and non-tariff barriers, particularly in agriculture, have frustrated Washington. The 2008 U.S.-India Civil Nuclear Agreement and $20 billion in U.S. arms purchases by 2025 signaled strategic alignment, but India’s refusal to liberalize markets strained ties.

The 2022 Russia-Ukraine conflict exposed India’s opportunism. For instance, Russian oil imports surged from 3% to 35% by 2024, saving $5 billion annually but antagonizing the West. Trump’s first term saw India lose GSP status in 2019, prompting petty retaliatory tariffs. His 2025 tariffs, announced July 31 and escalated August 6, target India’s $68.7 billion Russia trade, reflecting frustration with its non-aligned posturing. India’s 2019 compliance on Iranian oil contrasts with its 2025 defiance, a reckless shift that risks economic and diplomatic isolation.

Trump’s Tariff Offensive: Why India Faces the Heat

Trump’s 50% tariffs, effective August 7 (25%) and August 27 (additional 25%), aim to choke Russia’s war economy by targeting India, its second-largest oil buyer. For example, Trump’s August 4 post claimed India’s oil profits sustain Russia’s “war machine.” He also criticizes India’s trade surplus and high tariffs, calling it a “tariff king.” The tariffs align with his 12-day Ukraine ceasefire deadline, pressuring India to comply. India’s Ministry of External Affairs (MEA) countered that its imports stabilize global oil prices, accusing the U.S. and EU of hypocrisy (EU-Russia trade: 38.4% of Moscow’s total in 2024). However, India’s five failed trade talks with the U.S. in 2025, over farm access and oil, and its denial of Trump’s India-Pakistan ceasefire claim reveal diplomatic clumsiness, leaving it vulnerable.

Economic Fallout: India’s Vulnerable Underbelly

The 50% tariffs threaten India’s $91 billion U.S. export market, its largest, with $54 billion in goods (textiles, gems, shrimp, chemicals) facing the full levy. For instance, UBS estimates $8 billion in exports at risk, while Moody’s predicts a 0.3% GDP contraction, potentially dropping FY26 growth below 6%. The Federation of Indian Export Organisations (FIEO) warns of a 30–35% competitive disadvantage against Vietnam and Bangladesh, risking layoffs in MSMEs. The rupee weakened, and Nifty 50 fell 0.7% in August 2025, reflecting market jitters. Exemptions for pharmaceuticals and semiconductors offer relief, but U.S. consumers face higher prices, with Diageo estimating a $200 million hit. India’s $250 billion reserves and domestic demand cushion the blow, but its overreliance on U.S. markets exposes economic naivety.

India’s Options: Strategic Choices or Reckless Gambles?

Can India outsmart Trump’s 50% tariffs over Russian oil? In fact, India faces a narrowing window to counter Trump’s tariffs. Its options, each fraught with risks, include:

- Negotiate a Compromise: India could reduce Russian oil imports or open farm markets to secure a tariff rollback to 15%, as Japan did. However, Modi’s nationalist rhetoric, vowing to “pay a heavy price” for farmers, limits concessions, risking prolonged talks.

- Diversify Trade Partners: The EU ($110 billion trade), ASEAN ($120 billion), and Japan ($20 billion) offer alternatives. The 2025 India-UK FTA boosts jewellery exports, but replacing the U.S. market fully is unrealistic, exposing India’s overconfidence.

- Retaliatory Tariffs: India could target U.S. goods like almonds, as in 2019, but this risks escalating a trade war, further isolating India diplomatically.

- Domestic Support Measures: Subsidies and export credits could aid MSMEs, but fiscal strain from a $9–12 billion oil import cost hike (if Russian oil is replaced) limits viability.

- Deepen BRICS Ties: Strengthening trade with Russia ($68.7 billion) and China ($118 billion) could offset losses, but risks Western alienation, as seen in Canada’s 2025 G7 snub.

India’s state refiners paused Russian oil spot purchases in August 2025, buying from the U.S. and Middle East, but long-term contracts complicate a full shift. These options highlight India’s precarious balancing act, with defiance potentially outweighing pragmatism.

Domestic Political Pressures: Modi’s Nationalist Trap

Modi’s defiance, while rallying his BJP base, faces domestic scrutiny. For example, Congress leader Mallikarjun Kharge accused the government of “disastrously dithering,” warning against abandoning non-alignment. Modi’s August 8 speech, prioritizing farmers, signals resistance to U.S. farm access demands, but risks alienating urban voters hit by export losses. The 2025 Operation Sindoor fallout, where India faced global criticism, underscores the domestic cost of diplomatic isolation. Modi’s rhetoric, while politically expedient, may lock India into a confrontational stance, undermining economic reforms needed to counter tariffs.

Global Perceptions: India’s Waning Credibility

India’s defiance has drawn mixed global reactions. For instance, China’s ambassador Xu Feihong backed India, criticizing U.S. tariffs as “bullying.” Brazil’s President Lula da Silva, in an August 8 call with Modi, advocated BRICS coordination. However, Western allies view India’s Russian ties skeptically. Canada’s G7 exclusion of Modi and EU sanctions on Indian refiners signal growing frustration. India’s claim of stabilizing oil markets rings hollow when China, a larger Russian oil buyer, faces only 30% U.S. tariffs, highlighting India’s diplomatic misstep in antagonizing Washington. This perception of strategic arrogance could erode India’s global standing, especially in the Quad.

Will India Pivot to the China-Russia Camp?

India’s August 8 Modi-Putin call and planned China visit for the SCO summit suggest a BRICS tilt. For example, Russia’s $68.7 billion trade and China’s $118 billion trade offer economic lifelines. However, a complete pivot is improbable. India’s $20 billion U.S. arms deals, Quad commitments, and 2020 Galwan clash with China anchor it to the West. The U.S. absorbs 28% of India’s textile exports and 20% of pharmaceuticals, critical sectors. A full shift risks visa restrictions for Indian tech workers and offshoring losses, as analysts warn. India’s non-aligned posturing, while appealing domestically, may leave it isolated if it overplays BRICS ties.

Role of Allies: Can Israel and Others Save India?

Israel, a close Indian ally, could mediate tariff talks, leveraging its U.S. influence. For instance, Prime Minister Benjamin Netanyahu’s August 8 statement called U.S.-India ties “solid,” offering diplomatic support. Israel’s $2 billion defense trade, including drones, could expand to offset U.S. arms pauses. The UAE, via the 2022 CEPA, and Japan ($20 billion trade) can absorb textile and electronics exports. The EU, post-India-UK FTA, offers a $110 billion market. However, these allies cannot replace the U.S.’s $131.8 billion trade volume or its strategic weight in the Quad. India’s overreliance on limited allies reflects a strategic miscalculation, as none can fully shield it from Trump’s tariffs.

Comparative Case Studies: Lessons from Other Nations

India can learn from nations navigating U.S. tariffs. For example, Japan secured a tariff reduction to 15% in 2025 by offering agricultural concessions, a model India resists due to domestic pressures. Pakistan’s 2025 U.S. oil deal, avoiding tariffs, showcases pragmatic alignment with Washington, contrasting India’s defiance. Brazil’s BRICS coordination with India suggests collective resistance, but its smaller $11.6 billion Russia trade limits its exposure. These cases highlight India’s error in prioritizing nationalist rhetoric over flexible diplomacy, risking economic isolation.

Future Prospects: A Precarious Path

Three scenarios loom:

- Compromise: India could reduce Russian oil imports by 10%, securing a tariff cut to 20% by September 2025, preserving U.S. ties. However, Modi’s rhetoric limits flexibility.

- Escalation: Persistent defiance may trigger secondary sanctions, costing $10 billion annually. India could retaliate with tariffs, deepening the trade war.

- Stalemate: India may absorb losses via EU and ASEAN markets, maintaining Russian oil imports until Trump’s August 8 Ukraine deadline passes, betting on U.S. midterm shifts.

India’s $250 billion reserves and $3.5 trillion domestic market provide resilience, but a 0.6–1% GDP hit looms without action. Its non-aligned stance may persist, but overconfident posturing risks long-term isolation.

Conclusion: India’s High-Risk Gamble

Trump’s 50% tariffs expose India’s strategic missteps in prioritizing Russian oil over U.S. ties. For instance, the $54 billion export hit threatens growth, yet India’s defiance, driven by domestic politics, risks diplomatic isolation. Options like negotiation, diversification, or BRICS alignment offer paths forward, but each carries risks of economic or geopolitical fallout. Allies like Israel can mitigate but not eliminate U.S. reliance. India’s non-alignment, while bold, teeters on arrogance, undermining its global credibility. The next 19 days will test whether India can outsmart Trump’s tariff trap or succumb to its own hubris.