(By Khalid Masood)

Introduction

In the volatile chessboard of global trade, the 2025 U.S.-India standoff over India’s obstinate reliance on Russian oil has laid bare New Delhi’s diplomatic hubris. For instance, President Donald Trump’s August 4, 2025, Truth Social post threatened to “substantially raise” tariffs on Indian exports for continuing to import 35% of its crude from Russia, a move fueling Moscow’s war machine. India, under Prime Minister Narendra Modi, responded with defiant arrogance, vowing to maintain these purchases despite the risk of economic isolation. Consequently, this clash, rooted in India’s refusal to align with Western sanctions and its inflated sense of strategic autonomy, raises pivotal questions: Can the U.S. ignore India’s overhyped market? Can India survive without its largest export destination? This article examines the historical context, dissects the standoff’s pros and cons, evaluates mutual trade dependence, and predicts future outcomes, highlighting India’s reckless defiance and the U.S.’s justified frustration.

Historical Context of U.S.-India Trade Relations

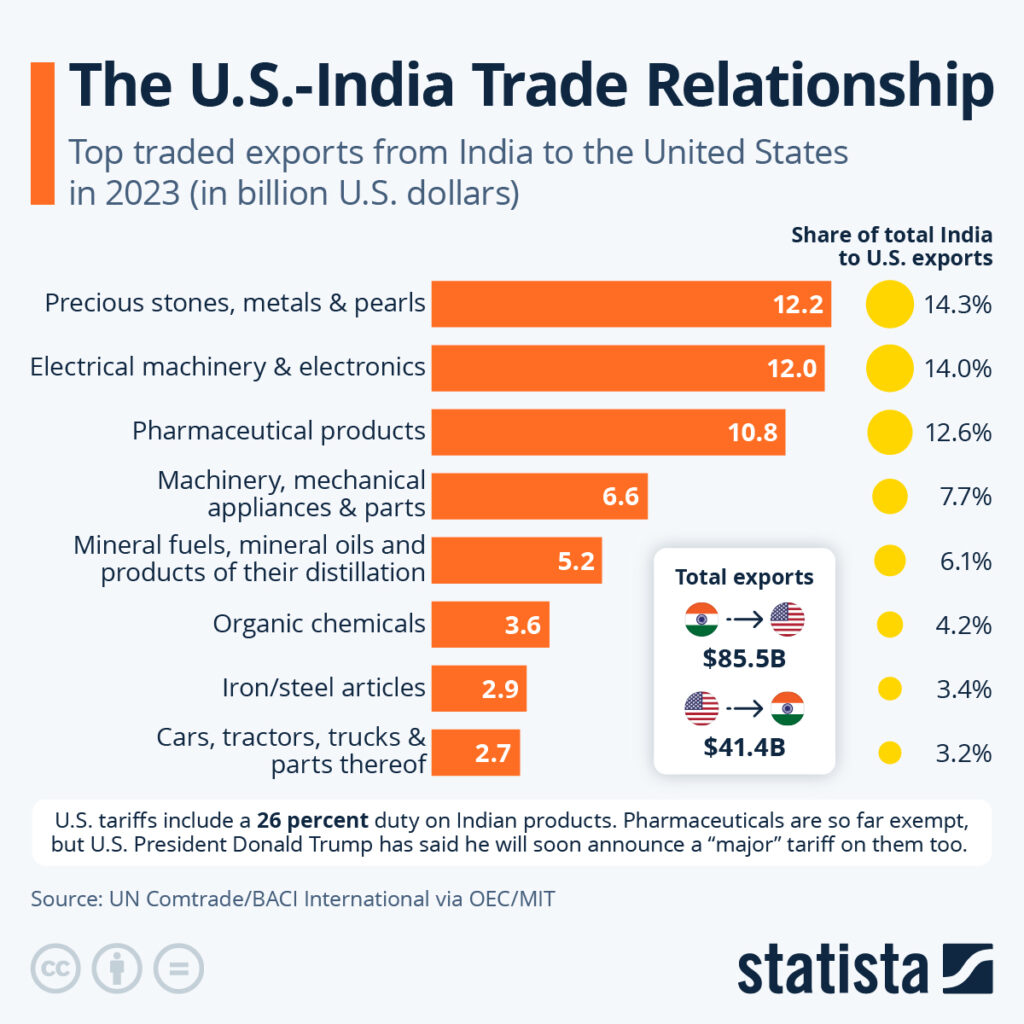

U.S.-India trade relations, while growing, have long been marred by India’s protectionist tendencies and diplomatic overreach. For example, during the Cold War, India’s Soviet alignment and non-aligned posturing strained ties with Washington, which backed Pakistan. India’s 1991 liberalization boosted trade from $5.6 billion in 1990 to $130 billion by 2024, making the U.S. India’s largest export market. However, India’s $45.8 billion trade surplus in 2024, driven by pharmaceuticals and textiles, reflects its reluctance to open markets, with 12% average tariffs stifling U.S. goods.

The 2008 U.S.-India Civil Nuclear Agreement briefly aligned interests, with India purchasing $20 billion in U.S. arms by 2025. Yet, tensions persisted. For instance, Trump’s first term saw India lose GSP status in 2019, prompting retaliatory tariffs on U.S. products like almonds. India’s high tariffs and non-tariff barriers, especially in agriculture, frustrated U.S. negotiators. The 2022 Russia-Ukraine conflict exposed India’s opportunism, as it ramped up Russian oil imports from 3% to 35% by 2024, exploiting discounts while ignoring Western sanctions. India’s compliance with U.S. pressure on Iranian oil in 2019 contrasts with its 2025 defiance, revealing a pattern of strategic flip-flopping that undermines its global credibility.

The 2025 Tariff Standoff

On July 30, 2025, Trump announced a 25% tariff on Indian exports, effective August 7, citing India’s Russian oil and arms purchases. He escalated on August 4, threatening further hikes, stating, “India is buying massive amounts of Russian oil, then selling it for big profits, undermining our sanctions.” India’s External Affairs Ministry, in a tone of wounded pride, called the targeting “unfair,” falsely claiming alignment with the G7-EU price cap. For example, India’s oil imports, at 1.75 million barrels daily, fuel Russia’s economy, contradicting its moral posturing. Modi’s government, stung by Trump’s public rebuke and his Pakistan oil deal, vowed to continue Russian imports, citing long-term contracts and energy needs.

India’s response reeks of arrogance. For instance, Energy Minister Hardeep Singh Puri’s claim that India’s imports stabilize global markets ignores their role in sustaining Russia’s war. The standoff, worsened by India’s denial of Trump’s 2025 India-Pakistan ceasefire mediation, highlights New Delhi’s diplomatic isolation. Modi’s defiance, driven by domestic nationalist pressures, risks economic fallout, as India’s stock markets dipped 3% post-tariff announcement. Thus, India’s reckless stance contrasts with the U.S.’s strategic pressure, exposing New Delhi’s miscalculation in a multipolar world.

Pros and Cons for the United States

Pros

- Curbing Russia’s War Economy: Tariffs pressure India, Russia’s largest oil buyer, to reduce $68.7 billion in trade, weakening Moscow’s Ukraine campaign. For example, secondary sanctions could disrupt India’s oil refining profits.

- Addressing Trade Imbalances: The U.S. targets India’s $45.8 billion trade surplus. Tariffs may force India to lower its 12% tariffs, opening markets for U.S. agriculture and dairy.

- Geopolitical Realignment: Favoring Pakistan’s 2025 oil deal pressures India to abandon Russian ties, reinforcing U.S. leverage in South Asia against China.

Cons

- Risk to Indian Market Access: India, the U.S.’s 12th-largest trading partner, supplies 20% of generic drugs. Tariffs could divert Indian exports to China or the EU, reducing U.S. market share.

- Consumer Price Hikes: Tariffs will raise U.S. costs for Indian pharmaceuticals and electronics. Diageo’s $200 million hit signals broader economic impacts.

- Weakening Indo-Pacific Strategy: Alienating India, a key counterweight to China, risks pushing it toward BRICS allies, undermining $20 billion in U.S. arms deals.

Pros and Cons for India

Pros

- Energy Affordability: Russian oil, at 35% of imports, saves India $5 billion annually, per the IEA. Continuing purchases ensures energy for 1.4 billion people.

- Domestic Political Gains: Modi’s defiance counters accusations of weakness, bolstering BJP’s nationalist image ahead of elections.

- Alternative Markets: India’s trade with the EU ($110 billion) and Japan ($20 billion), plus the 2025 India-UK CETA, offsets U.S. export losses.

Cons

- Economic Fallout: A 25% tariff could cost India $10 billion yearly, hitting pharmaceuticals and textiles. For instance, Ajay Sahai warned of reduced U.S. demand.

- Diplomatic Isolation: India’s Russian ties alienate Western allies. Canada’s 2025 G7 snub reflects growing criticism of India’s Kashmir policies.

- Defense and Technology Risks: Tariffs threaten $20 billion in U.S. arms deals and technology transfers, critical for India’s military modernization.

Can the U.S. Ignore the Indian Market?

The U.S. cannot lightly dismiss India’s market, despite Trump’s bravado. For example, India’s $130 billion trade with the U.S. in 2024 supports American industries, with India supplying 20% of generic drugs and surpassing China in smartphone production. The 4.4 million Indian diaspora and 241 million air passengers bolster cultural and economic ties. However, Trump’s protectionism prioritizes short-term revenue, with 2025 tariffs on 69 countries generating significant funds. Ignoring India risks long-term losses, as India could redirect exports to the EU or Japan. Moreover, India’s role in countering China, via $20 billion in U.S. arms, is vital. Pushing India toward BRICS risks weakening U.S. strategic goals, making sustained disengagement impractical.

Can India Survive Without U.S. Trade?

India’s economy, while tied to the U.S., can endure reduced trade, but not without pain. For instance, $74 billion in U.S. exports (11% of total exports) face tariff risks, impacting pharmaceuticals and gems. India’s $3.5 trillion domestic market absorbs production, and trade with the EU and ASEAN provides alternatives. However, replacing Russian oil with costlier U.S. or Saudi crude could raise prices by $10 per barrel, straining consumers. India’s $120 billion defense budget relies on U.S. technology, and tariffs could disrupt Rafale and AMCA programs. Modi’s defiance, while politically expedient, risks economic isolation, as seen in the 2025 Operation Sindoor fallout. Thus, India’s survival is possible but costly without U.S. trade.

Lessons for Third World Countries

The U.S.-India standoff offers lessons for third world nations navigating superpower pressures. For instance, India’s defiance, while bold, exposes its overreliance on domestic rhetoric over diplomatic pragmatism. Smaller nations should emulate Pakistan’s 2025 oil deal with the U.S., balancing ties with multiple powers. Moreover, investing in domestic markets, as India does, mitigates trade shocks. However, India’s failure to secure global support post-Sindoor shows the risks of alienating allies. For example, third world countries should leverage multilateral forums, like the OIC or ASEAN, to counter unilateral pressures, ensuring economic and strategic resilience in a multipolar world.

Historical Precedents and Future Predictions

Historically, India bent to U.S. pressure, halting Iranian oil imports in 2019 at great cost. The 2025 standoff, however, sees India’s arrogance drive defiance, emboldened by BRICS and domestic markets. The 2025 Operation Sindoor clash, where India faced global isolation, reinforces its resolve to resist. Future scenarios include:

- Escalation: Trump may impose 50% tariffs, forcing India to diversify oil sources. India could retaliate with tariffs or BRICS-led energy deals.

- Negotiation: Five 2025 backchannel talks suggest a compromise, with India reducing Russian oil and the U.S. lowering tariffs to 15%.

- Stalemate: India’s defiance could persist until Trump’s August 8 Ukraine deadline, absorbing economic hits via alternative markets.

India’s pivot to Russia and China risks Western alienation but strengthens BRICS. The U.S., needing India’s market, may soften its stance to preserve strategic ties.

Conclusion

The 2025 U.S.-India trade standoff, sparked by Trump’s tariff threats over India’s Russian oil purchases, exposes New Delhi’s arrogant defiance. For instance, India’s refusal to align with Western sanctions, while politically expedient, risks $10 billion in trade losses and diplomatic isolation. The U.S. gains leverage but jeopardizes India’s market and Indo-Pacific role. Neither can fully disengage: the U.S. needs India’s economic and strategic weight, while India relies on U.S. trade and technology. Future talks may ease tensions, but India’s reckless posturing threatens its global standing, underscoring the need for pragmatic diplomacy in a multipolar world.