(By Khalid Masood)

In late January 2026, the United States has significantly bolstered its military presence in the Middle East, centering on the deployment of the USS Abraham Lincoln Carrier Strike Group to waters near Iran. President Donald Trump has described this as a “massive armada” positioned to act with “speed and violence” if necessary, amid stalled nuclear talks and warnings tied to Iran’s nuclear ambitions.

This naval force, featuring the nuclear-powered aircraft carrier USS Abraham Lincoln and its escorts—including guided-missile destroyers—has arrived in the Indian Ocean and Arabian Sea region, as confirmed by U.S. Central Command (CENTCOM). Trump has urged Iran to negotiate a deal ensuring “NO NUCLEAR WEAPONS,” warning that any future U.S. action would be “far worse” than the strikes of June 2025. Iran has rejected these threats, vowing a strong response to any aggression.

The current tensions echo the events of mid-2025, when the U.S. directly intervened in an Iran-Israel conflict by launching Operation Midnight Hammer against key Iranian nuclear sites. This article examines the historical context, details of the ongoing build-up, statements from key figures, Iran’s perspective, and a neutral analysis of the risks and implications.

Background: The June 2025 Strikes and Aftermath

The roots of the current standoff trace back to June 2025, during a brief but intense war between Iran and Israel. On June 22, 2025, U.S. forces executed Operation Midnight Hammer, targeting three major Iranian nuclear facilities: Fordow (an underground uranium enrichment plant), Natanz (a major enrichment complex), and Isfahan (a nuclear technology/research center).

The operation involved over 125 aircraft, including seven B-2 Spirit stealth bombers that dropped 14 GBU-57 Massive Ordnance Penetrators (30,000-pound “bunker-busters”) on Fordow and Natanz. A U.S. submarine launched dozens of Tomahawk cruise missiles at Isfahan. U.S. officials claimed the strikes severely damaged or destroyed the sites, setting back Iran’s nuclear program significantly. Initial intelligence assessments suggested the damage was severe to aboveground structures but may have only delayed the program by months, as core underground components and enriched uranium stockpiles could have survived or been relocated beforehand.

Iran retaliated by firing missiles at the U.S. Al Udeid Air Base in Qatar, with no reported American casualties. A ceasefire followed shortly after, though both sides accused each other of violations.

Post-strikes, Iran has reportedly resumed rebuilding efforts, resisted IAEA inspections, and maintained its enrichment activities. The regime faced domestic unrest in late 2025 into early 2026, with nationwide protests over economic issues and governance leading to a crackdown, reportedly resulting in hundreds of deaths according to UN and human rights sources.

Trump’s second-term policy has revived “maximum pressure,” demanding Iran halt all uranium enrichment permanently, limit ballistic missiles, and cease support for proxy groups like Hezbollah, Hamas, and the Houthis.

The Current U.S. Military Build-Up (January 2026)

As of late January 2026, the U.S. has conducted its largest regional reinforcement since the 2025 strikes. The centerpiece is the USS Abraham Lincoln Carrier Strike Group (CVN-72), which transited from the South China Sea, arriving in the Middle East region around January 26. The group includes Carrier Air Wing Nine (with F/A-18E/F Super Hornets, F-35C stealth fighters, EA-18G Growlers for electronic warfare, E-2D Hawkeyes, and helicopters), plus three Arleigh Burke-class destroyers.

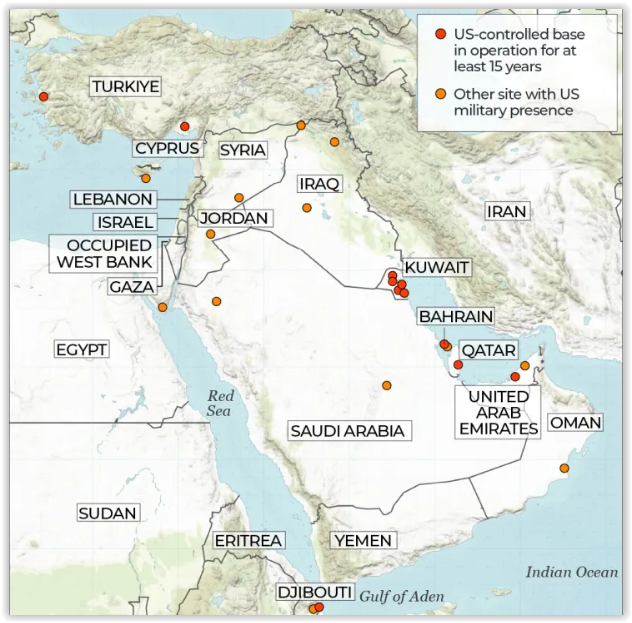

This deployment adds roughly 5,700 personnel, bringing total U.S. troops in the Middle East to about 40,000–50,000 across bases in Bahrain, Qatar (Al Udeid), UAE, Saudi Arabia, Jordan, and others.

Additional assets include:

- Approximately 35 F-15E Strike Eagles deployed to Jordan.

- THAAD and Patriot missile defense batteries positioned across the Gulf.

- Tanker aircraft, P-8A Poseidon patrol planes, MQ-9 Reaper drones, and refueling/C-17 transports surged to regional hubs.

- Multi-day aerial readiness exercises across CENTCOM’s area (over 20 nations), demonstrating rapid deployment and sustained operations.

CENTCOM describes the posture as promoting “regional security and stability” and deterring threats. Compared to June 2025’s offensive strike package (stealth bombers, massive bunker-busters), the current build-up is more naval- and defensive-oriented, with one carrier group enabling rapid airpower projection but no confirmed preparations for imminent strikes.

Trump’s Threats and Diplomatic Stance

President Trump has escalated rhetoric significantly. In late January statements, he posted on social media urging Iran to negotiate “a fair and equitable deal – NO NUCLEAR WEAPONS,” warning “time is running out” and that the next attack “will be far worse” than 2025’s.

He described the armada as “ready, willing, and able to rapidly fulfill its mission, with speed and violence, if necessary,” comparing it favorably to deployments before other operations. Initial focus tied threats to the protest crackdown (“help is on the way”), but emphasis shifted to nuclear demands after indirect talks (via Oman) stalled.

U.S. demands reportedly include permanent uranium enrichment cessation, missile limits, and ending proxy support. Trump has hinted at regime change possibilities but frames the posture as coercive diplomacy to force concessions.

Iran’s Position and Responses

Iran faces a dilemma: negotiating could mean humiliating concessions on core issues like enrichment (viewed as a sovereign right for peaceful purposes), while resistance risks strikes amid internal weakness from the protests.

Tehran has rejected Trump’s ultimatums, vowing an “immediate and powerful” response to any attack, including targeting U.S. forces, Israel, or allies using regional airspace. Officials claim readiness to retaliate asymmetrically via missiles, drones, proxies, or Strait of Hormuz disruptions.

Despite the regime’s crackdown (with reports of hundreds killed), it remains resilient, reportedly, rebuilding nuclear capabilities and barring full IAEA access.

Analysis: Motivations, Risks, and Implications

From the U.S. perspective, the January 2026 military build-up—centered on the USS Abraham Lincoln Carrier Strike Group, additional fighter squadrons, and layered missile defenses—functions primarily as coercive diplomacy. The goal is to prevent Iran from achieving nuclear breakout by rebuilding capabilities damaged in the June 2025 strikes (Operation Midnight Hammer), while deterring proxy aggression through Iran’s weakened “Axis of Resistance.” Defensive assets like THAAD and Patriot batteries, along with tanker support for extended operations, indicate preparation for absorbing and countering potential Iranian retaliation rather than an imminent large-scale offensive. This posture also protects key allies—Israel (which has repeatedly warned against Iran reconstituting its nuclear or missile programs) and Gulf states (concerned about threats to shipping and energy infrastructure)—and signals domestic strength to Trump’s base, reinforcing his “maximum pressure” revival. Experts note that the build-up enhances leverage in stalled indirect talks (via Oman), pressuring Tehran to accept demands for zero enrichment, ballistic missile curbs, and proxy disengagement.

Iran, conversely, perceives this as naked aggression and interference in its sovereignty, framing the U.S. presence as hybrid warfare designed to exploit internal vulnerabilities. Tehran relies on asymmetric capabilities—ballistic missiles (with ranges covering U.S. bases and allies), drone swarms, cyber operations, and its proxy network—for deterrence. Despite the regime’s weakened state after the late-2025/early-2026 protests (with hundreds reportedly killed in the crackdown and economic collapse fueling unrest), compromise remains risky: conceding on enrichment or proxies could signal fatal weakness, emboldening further external pressure or internal challengers. Iranian officials, including Foreign Minister Abbas Araghchi, have rejected negotiations “under threats,” insisting any deal must be “mutually beneficial, fair, and equitable” while preserving peaceful nuclear rights. The regime has rebuilt some nuclear infrastructure post-2025 (per its claims and IAEA assessments showing partial recovery), barred full inspections, and placed forces on high alert, vowing “immediate and powerful” retaliation.

The risks of escalation are substantial and multifaceted. A miscalculation—such as an Iranian proxy strike on U.S. assets or a limited U.S. “precision” action targeting IRGC commanders tied to protest suppression—could spiral into broader conflict. Potential flashpoints include direct hits on U.S. bases (e.g., Al Udeid in Qatar), oil infrastructure in the Gulf, or allies like Israel and Saudi Arabia. Regional spillover looms large: Yemen’s Houthis have raised alert levels and hinted at resuming Red Sea shipping attacks; Iraqi militias like Kataib Hezbollah have warned of “total war,” threatening U.S. positions in Iraq and beyond; Hezbollah in Lebanon, though degraded from prior conflicts, remains a latent threat. Closing or disrupting the Strait of Hormuz (through which ~20% of global oil flows) could spike energy prices, hammering Asian and European economies. Gulf allies are notably cautious, refusing airspace or basing for offensive operations against Iran to avoid becoming targets.

Expert opinions vary on immediacy but converge on high inherent danger. Some analysts assess a “very high” likelihood of limited U.S. strikes (e.g., on nuclear/missile sites or IRGC facilities) given the posture and Trump’s rhetoric, with defensive assets enabling rapid response. Others emphasize lower probability of full-scale war due to high costs—economic blowback, potential multi-front retaliation, and domestic U.S. aversion to another prolonged Middle East entanglement—especially after protests have been largely quelled. The build-up is seen as enabling quick action while keeping diplomacy viable via backchannels, but failure to resume talks (no progress reported in recent weeks) heightens miscalculation risks. Broader implications are profound: accelerated Iranian nuclear efforts could spark regional proliferation (e.g., Saudi or Turkish responses); unilateral U.S. action might strain alliances (Gulf states hedging, Europe wary); and persistent volatility underscores the Middle East’s fragility, with oil market shocks, refugee flows, and great-power rivalries (Russia/China backing Iran) amplifying global instability.

In sum, this standoff pits U.S. military superiority and coercive leverage against Iran’s asymmetric resilience and survival calculus. While the current posture deters and pressures, it also teeters on the edge of unintended escalation in an already volatile region.

Conclusion

The January 2026 U.S. build-up near Iran represents a high-stakes standoff: Washington leverages military superiority for leverage on nuclear and regional issues, while Tehran confronts bad options in a weakened position. Fluid developments—watch for talks resumption or further escalation—underscore the persistent fragility of U.S.-Iran relations.