(By Quratulain Khalid)

Introduction

In early January 2026, a bombshell announcement from U.S. Senator Lindsey Graham sent shockwaves through Indian social media and financial markets. President Donald Trump had reportedly “greenlit” the Sanctioning Russia Act of 2025, a bipartisan bill that could impose tariffs of at least 500% on all goods and services from countries continuing to purchase Russian oil, gas, or uranium. India, one of the world’s largest importers of discounted Russian crude, was explicitly named as a primary target alongside China and Brazil. The news triggered a frenzy online, with hashtags like #500PercentTariff and #IndiaVsTrump trending, memes mocking the potential economic fallout, and heated debates about India’s energy choices versus U.S. geopolitical demands.

This threat marks the latest chapter in escalating tensions between the U.S. and India over Russia’s ongoing war in Ukraine. While the U.S. aims to starve Russia’s war machine of funding by targeting secondary buyers, India defends its imports as essential for affordable energy in a nation of 1.4 billion people. The potential tariffs could devastate bilateral trade, worth over $120 billion annually, and force a reevaluation of alliances in a multipolar world. Yet, as of January 10, 2026, the bill remains pending in Congress, serving more as leverage than immediate policy. This article explores the background, timeline, implications, and possible paths forward in this high-stakes standoff.

Background: India’s Russian Oil Strategy Post-2022

India’s pivot to Russian oil began in earnest after Western sanctions were imposed on Russia following its 2022 invasion of Ukraine. With global energy prices soaring, India capitalized on heavily discounted Russian crude, which helped stabilize domestic fuel costs and curb inflation amid post-pandemic recovery. By 2023, Russia had overtaken traditional suppliers like Iraq and Saudi Arabia, accounting for up to 40% of India’s oil imports at peak levels.

This strategy was driven by economic pragmatism: Russian oil was often 20-30% cheaper than alternatives, saving India billions in foreign exchange reserves. Major refiners like Reliance Industries and state-owned Indian Oil Corporation ramped up purchases, with imports hitting record highs of around 2 million barrels per day (mbpd) in mid-2024. However, this came at a diplomatic cost. The U.S. and its allies viewed these deals as indirectly funding Russia’s military efforts, prompting repeated calls for India to diversify away from Moscow.

Recent data shows a shift: India’s Russian oil imports declined sharply in late 2025, dropping from about 1.8 mbpd in November to 1.0-1.24 mbpd in December, according to analytics firm Kpler. Factors included rising prices for Russian grades like Urals crude, payment hurdles due to secondary sanctions on banks, and quiet U.S. pressure. Reliance, India’s largest buyer, even halted deliveries for January 2026. Despite this, India maintains that its energy decisions are sovereign, emphasizing the need to secure the cheapest supplies for its population while gradually increasing imports from the U.S. and Middle East.

Timeline of Escalating U.S. Pressure

The current crisis didn’t emerge in a vacuum. U.S.-India trade frictions under Trump date back to his first term (2017-2021), when he labeled India a “tariff king” and revoked its preferential trade status. The Russian oil issue amplified these tensions post-2022.

- Pre-2025: Initial U.S. sanctions targeted Russian entities, but secondary pressures on buyers like India were limited. Diplomatic nudges encouraged diversification, with some success—India’s U.S. oil imports rose modestly.

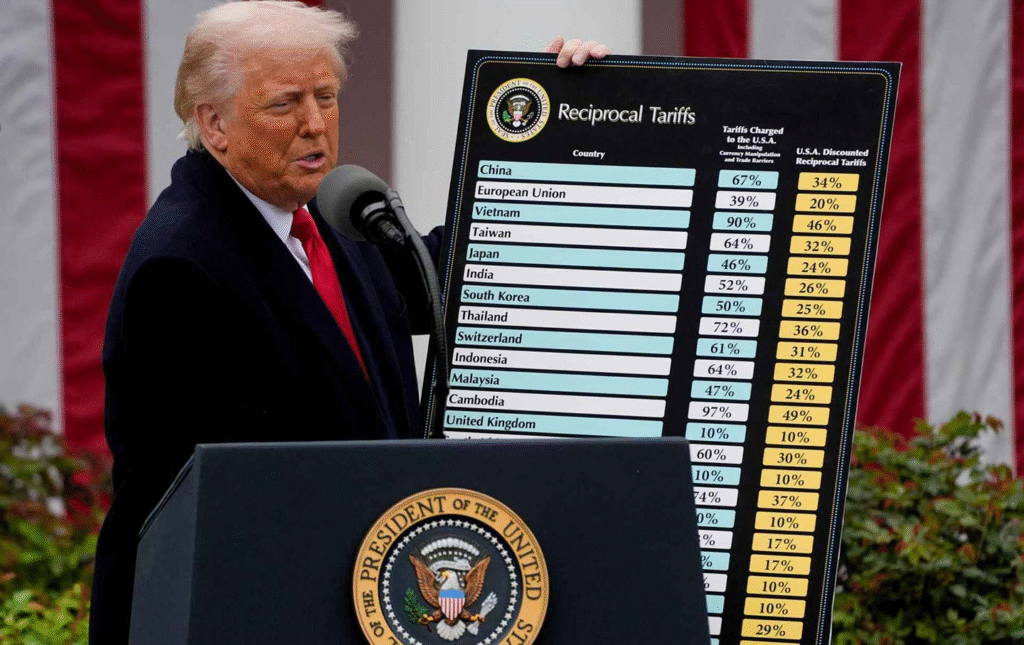

- August 2025: Shortly after Trump’s reelection and inauguration, the administration imposed “reciprocal tariffs” on Indian exports, starting at 25%, plus an additional 25% penalty specifically linked to Russian oil purchases. This resulted in effective duties of up to 50% on key sectors like pharmaceuticals, textiles, and IT services—one of the highest rates applied to any trading partner.

- January 5, 2026: In a public statement reported by Reuters, Trump directly warned India that the U.S. could “act very quickly” with further tariffs unless it curbed Russian imports. This followed reports of India’s continued deals despite the August hikes.

- January 7-8, 2026: Senator Graham, a key Trump ally, announced via social media and press briefings that the president had “greenlit” the Sanctioning Russia Act of 2025. The bill, introduced in late 2025 with bipartisan support, could come to a vote as early as the following week. Concurrently, the U.S. withdrew from the India-led International Solar Alliance, citing broader policy misalignments.

- Ongoing Developments: The arrival of new U.S. Ambassador Sergio Gor in Delhi on January 12, 2026, is expected to focus on pushing India toward zero Russian imports, potentially through backchannel negotiations.

This timeline reflects Trump’s “America First” approach, using tariffs as a tool to enforce foreign policy goals.

Details of the Sanctioning Russia Act of 2025

The Sanctioning Russia Act of 2025 is a targeted piece of legislation aimed at intensifying pressure on Russia’s economy. Co-sponsored by Republicans like Graham and Democrats like Richard Blumenthal, it enjoys broad support in a divided Congress, positioning it as a rare bipartisan win.

Key provisions include:

- Tariff Mandates: The president must impose tariffs of at least 500% on all imported goods and services from countries that “knowingly” engage in significant trade of Russian-origin petroleum products or uranium. This threshold is vaguely defined, giving executive discretion.

- Secondary Sanctions: Penalties on financial institutions and companies facilitating such deals, including asset freezes and U.S. market exclusions.

- Waivers and Conditions: Tariffs could be waived if the targeted country demonstrates “good faith” reductions in Russian imports or if Russia engages in Ukraine peace talks. The act ties sanctions relief to broader diplomatic progress.

- Scope: While India, China, and Brazil are highlighted in the bill’s text (based on their import volumes), it applies globally, potentially affecting Turkey and others.

Trump’s “greenlight” signals his intent to use the bill as leverage, though full implementation would require congressional passage and his signature.

Economic and Trade Implications for India

A 500% tariff would be unprecedented, effectively acting as a trade embargo. India’s exports to the U.S.—valued at $85-120 billion annually—include critical sectors like pharmaceuticals (20% of U.S. generics), textiles, gems, jewelry, and software services. Such duties could:

- Halt Trade Flows: Render most exports unviable, leading to job losses in export-oriented industries and supply chain disruptions.

- Market Reactions: Indian stock indices like the Sensex and Nifty dipped 2-3% in early January 2026 amid the news, with oil and gas stocks hit hardest. Foreign investor outflows accelerated, exacerbating rupee depreciation.

- Broader Ripple Effects: Higher costs for Indian consumers if alternative markets can’t absorb the slack; potential challenges at the World Trade Organization (WTO), where India could argue violations of fair trade rules.

- Opportunities for Diversification: It might accelerate India’s push toward new trade pacts, like with the EU or ASEAN, though replacing the U.S. market would take years.

Experts note that while the threat is severe, actual imposition might be selective, focusing on symbolic sectors to encourage compliance without total rupture.

Geopolitical Dimensions

From the U.S. viewpoint, this is about ending the Ukraine conflict swiftly by isolating Russia economically. Trump has framed it as protecting American interests, arguing that countries like India benefit from U.S. security umbrellas while undermining sanctions.

India, however, prioritizes strategic autonomy in a multipolar world. As a BRICS member and Quad partner, it balances ties with the West and Russia, viewing energy imports as non-political necessities. China, a larger Russian oil buyer, faces similar pressures but holds more leverage due to its economic scale.

Globally, this could reshape energy markets: Reduced secondary demand might force Russia to sell at even steeper discounts or pivot to domestic use, while boosting U.S. and OPEC exports. It also tests alliances, potentially straining U.S.-India defense cooperation under initiatives like iCET (Initiative on Critical and Emerging Technology).

Responses and Counterarguments

India’s Ministry of External Affairs (MEA) has responded measuredly, stating it is “closely monitoring developments” while reaffirming commitment to energy security. Officials argue that imports have already declined and that India isn’t financing war but buying market-available oil.

Analysts are divided: Some, like those from the Observer Research Foundation, see the 500% figure as negotiating bluster, unlikely to be fully enacted. Others warn of an “economic shock” if ignored. On social media, reactions range from patriotic defiance (“India won’t bow”) to pragmatic calls for diversification.

U.S. critics, including some Democrats, question the bill’s efficacy, noting it could alienate key partners like India without significantly hurting Russia.

What Happens Next? Possible Scenarios

The bill’s fate hinges on Congress, with a potential vote imminent. Scenarios include:

- Passage and Full Tariffs: A trade war ensues, prompting India to seek WTO arbitration or retaliatory measures.

- Further Import Reductions: India accelerates diversification, earning waivers and de-escalating tensions.

- Diplomatic Resolution: Talks during Ambassador Gor’s visit lead to compromises, like joint energy projects.

- Long-Term Shifts: India invests more in renewables and domestic production, reducing vulnerability to such pressures.

Conclusion

The 500% tariff threat underscores the intersection of energy, economics, and geopolitics in today’s world. For India, it’s a test of balancing affordable energy with international partnerships; for the U.S., a bid to enforce global order through trade tools. While tensions are high, history shows room for diplomacy—previous U.S.-India spats, like over data localization, often resolved through dialogue. As developments unfold, the outcome could redefine not just bilateral ties but the broader dynamics of global energy flows. Stakeholders worldwide will watch closely, hoping for de-escalation over disruption.