(By Khalid Masood)

One year into his second non-consecutive term, President Donald Trump finds himself at a precarious juncture. On January 6, 2026, during a closed-door meeting with House Republicans, Trump issued a stark warning: If the GOP loses control of the House in the upcoming midterms, Democrats will impeach him for a third time, finding “any reason” to do so. Just two days later, on January 8, the Senate advanced a bipartisan War Powers Resolution in a 52-47 vote, with five Republicans joining Democrats to rebuke Trump’s unilateral military actions in Venezuela. These events underscore a growing vulnerability: declining approval ratings, internal party fractures, and unfavorable midterm forecasts that could reshape the final two years of his presidency.

Trump’s second term began with ambitious “America First” policies, including the dramatic U.S. raid that captured Venezuelan dictator Nicolás Maduro in early January 2026, followed by assertions of indefinite American oversight of Venezuela’s oil resources. Yet, persistent economic challenges like high living costs, international withdrawals from agreements, and congressional pushback have eroded public and partisan support. As the November 3, 2026, midterms approach—with all 435 House seats and 35 Senate seats on the ballot—Trump’s personal unpopularity risks dragging down Republican prospects, potentially handing Democrats the House and amplifying threats of impeachment.

This article examines the interconnected challenges facing Trump and the GOP: sinking approval numbers, midterm headwinds rooted in historical patterns, the realistic specter of impeachment, and emerging signs of disunity within Republican ranks.

Trump’s Approval Ratings: A Downward Trajectory

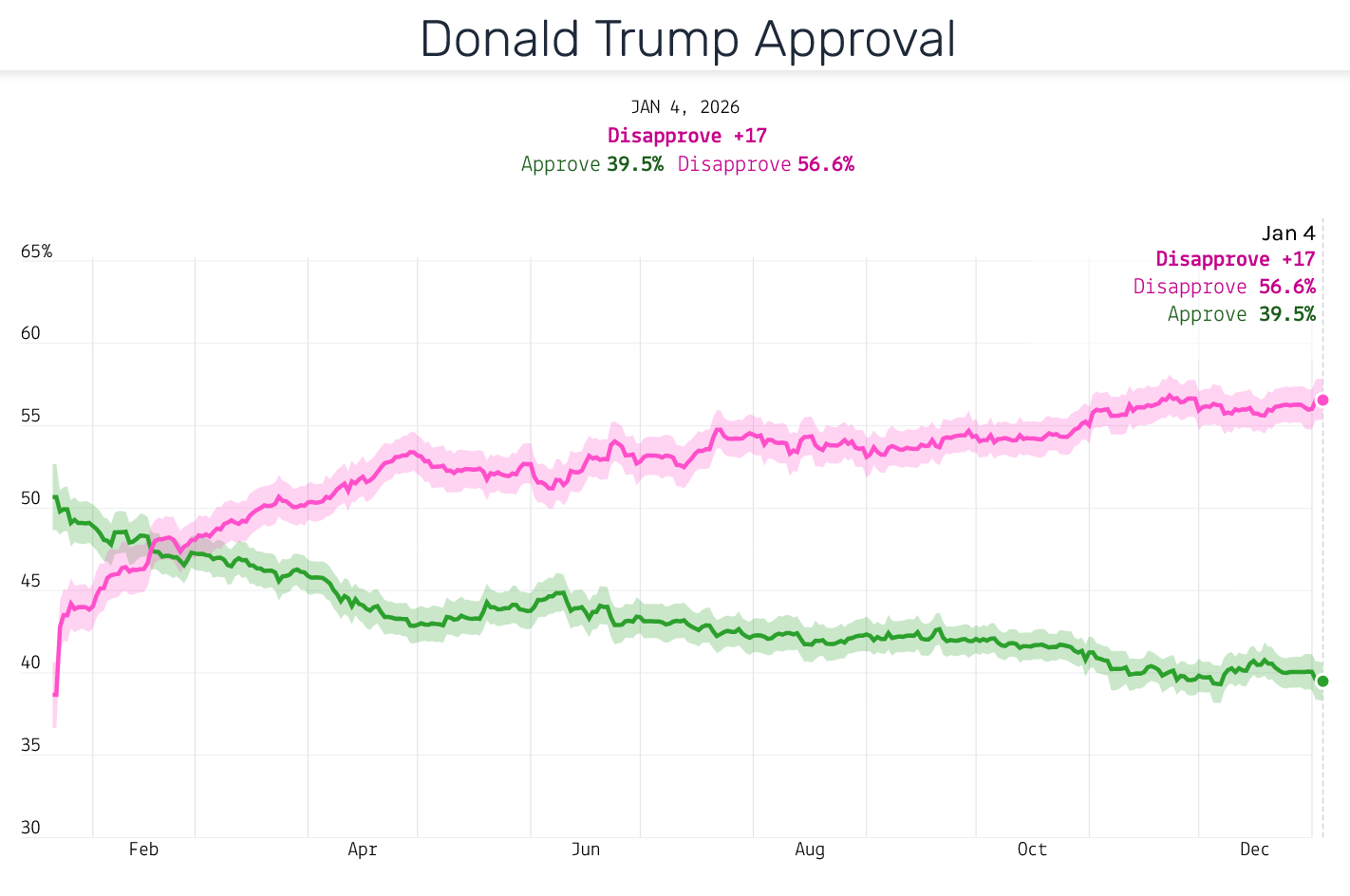

Charts showing President Trump’s approval ratings trending downward through late 2025 and into early 2026, with notable dips amid economic and foreign policy controversies.

As of January 2026, Trump’s approval rating hovers around 41-43%, with disapproval at 52-55%, according to aggregators like RealClearPolitics and Civiqs. This represents a modest rebound from late-2025 lows but remains underwater, a perilous position for any president heading into midterms. Among key demographics, support has softened significantly: independents, Hispanics, young voters, and lower-income Americans now approve at rates below 40% in many polls, despite near-unanimous backing from the Republican base (over 90%).

The primary culprits are economic anxieties—stubborn inflation and cost-of-living pressures that have overshadowed Trump’s messaging on immigration and energy independence—and controversial foreign policy moves. The Venezuela operation, while initially popular among hawks, has drawn criticism for its unilateral nature and long-term implications. Trump’s withdrawals from international bodies like the WHO and Paris Accord have further alienated moderates.

Historically, presidents with sub-50% approval at this stage face steep midterm losses. Trump’s numbers echo his first term, where similar ratings contributed to the 2018 House flip. Analysts note that while his core MAGA supporters remain loyal (though self-identification with the movement has dipped from 57% to 50% among Republicans), broader erosion among swing voters spells trouble for down-ballot candidates.

The 2026 Midterms: Historical Headwinds and Current Forecasts

Forecast maps for the 2026 House and Senate elections, highlighting competitive districts and the GOP’s narrow majorities.

The 2026 midterms will test Republican control of Congress, where they currently hold a razor-thin House majority (approximately 218-213 after recent vacancies) and a 53-47 Senate edge. History is unkind to the president’s party: When approval dips below 50%, average House losses exceed 28 seats.

For the House, forecasts are grim for Republicans. Democrats lead the generic congressional ballot—voters’ party preference for Congress—by 5-14 points in national polls. Prediction models suggest GOP losses of 20-30+ seats, potentially flipping control. Contributing factors include a record wave of Republican retirements (25-40 incumbents opting out, signaling internal pessimism), underperformance in 2025 special elections, and Trump’s drag in suburban swing districts.

The Senate map is more forgiving, with more Democratic seats up for grabs in GOP-leaning states. Republicans are favored to retain or even expand their majority, with prediction markets giving them 66-70% odds. However, a worsening national environment could jeopardize this.

Trump has alternated between predicting an “epic” GOP victory and expressing frustration with voter sentiment on affordability. GOP strategists worry his involvement could mobilize the base but alienate independents, repeating the 2018 blueprint for disaster.

congressional ballot poll trend, illustrating Democratic leads in similar historical contexts.

The Impeachment Specter: Motivation or Liability?

Trump’s January 6 warning to House Republicans—that a midterm loss would invite his impeachment—was both a rallying cry and an admission of vulnerability. “They’ll find a reason,” he reportedly said, invoking his two prior impeachments (2019 for abuse of power and 2021 for incitement).

If Democrats recapture the House, impeachment is feasible: It requires only a simple majority to approve articles. Some Democrats have already floated grounds related to the Venezuela action or other executive overreaches. However, Senate conviction demands 67 votes—two-thirds—including significant GOP defections, which remains unlikely even if Democrats gain seats.

Politically, Trump uses the threat to boost turnout, framing midterms as a firewall against partisan attacks. Yet it risks highlighting divisiveness. A Democratic House could wield investigations and subpoenas to paralyze his agenda, turning his final years into gridlock.

Signs of Fractures: Is Trump Losing Control Over the GOP?

The Senate’s advancement of the War Powers Resolution, sponsored by Democrat Tim Kaine and Republican Rand Paul, marks a rare congressional assertion against presidential war powers. The 52-47 procedural vote included five GOP defectors (Paul, Collins, Murkowski, Young, and Hawley), prompting Trump’s public criticism of “betrayal.”

This symbolic measure responds to the Maduro raid and Trump’s implications of prolonged U.S. involvement. Other signs of erosion include House Republicans overriding Trump on issues like healthcare subsidies and widespread retirements amid a toxic environment.

While Trump’s base loyalty endures, his influence over moderates and the broader party appears waning as he approaches 80 and term limits. Post-Trump GOP figures are already eyeing 2028, suggesting early lame-duck dynamics.

Conclusion: A Pivotal Year Ahead

Trump’s second term hangs in the balance as low approval, midterm vulnerabilities, impeachment risks, and party fractures converge. A GOP House loss could usher in investigations and stalemate; retention might embolden his agenda. The 2026 elections will serve as a referendum on his leadership, with history and polls pointing to challenging odds.

In an era of polarized politics, these developments not only shape Trump’s legacy but signal shifts in the Republican Party and U.S. foreign policy posture. As November approaches, the question remains: Can Trump rally his party, or will these cracks widen into a reckoning?