(By Khalid Masood)

In the evolving global energy and technological landscape of 2026, a profound divergence is reshaping power dynamics. While the United States under the Trump administration leans heavily into fossil fuel production—positioning itself as the world’s leading “petrostate“— China is forging ahead as the prototype “electrostate.” This model centers on abundant, low-cost electricity derived primarily from renewables, widespread electrification of transport, industry, and computing, mastery over critical mineral supply chains, and the rapid scaling of artificial intelligence (AI) and advanced manufacturing.

The concept of the “electrostate” highlights China’s strategic pivot: electricity now constitutes around 30% of final energy consumption in China (up from lower levels a decade ago and surpassing the U.S. at ~21% and the EU at ~23%). In 2025, China added unprecedented renewable capacity—over 300 GW of solar and more than 100 GW of wind—setting new global records. Clean energy sources drove most of the growth in power demand, contributing to the first simultaneous drop in coal power generation in China and India in over 50 years. This isn’t merely an environmental shift; it’s a calculated geostrategic move toward energy self-sufficiency, reduced vulnerability to imported fossil fuels, and leadership in the technologies defining the 21st century.

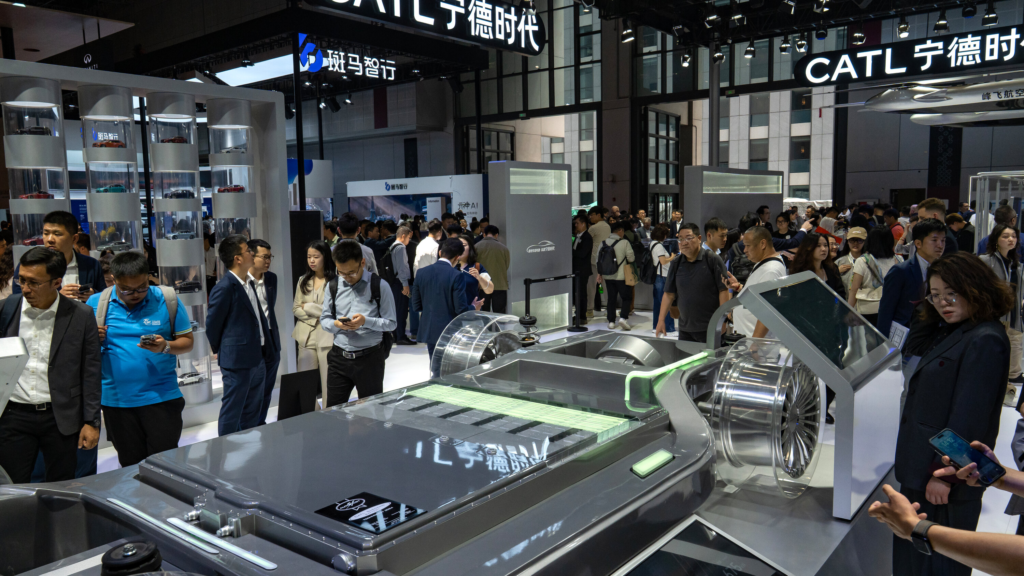

China’s advantages stem from decades of state-directed investment, massive grid expansion, and industrial policy that has built dominant positions in clean tech manufacturing. By dominating solar panels (over 80% of global supply), batteries and EVs (70%+), and wind turbines, China has driven down costs dramatically—solar module prices fell by around 80% in the past decade—while exporting these technologies worldwide. This creates economic leverage comparable to traditional oil exporters, but with cleaner, more sustainable foundations.

Pillar 1: Rapid Domestic Electrification and Clean Energy Leadership

China’s electrification is accelerating at a pace unmatched elsewhere. Total electricity consumption in 2025 reached record levels, with non-fossil sources—particularly solar and wind—meeting the bulk of new demand. Solar generation surged by over 40% year-on-year in parts of 2025, while wind grew steadily. By the end of 2025, installed solar capacity exceeded 1.16 billion kW (a 41.9% increase), and wind reached 600 million kW (up 22.4%). Combined wind and solar additions in 2025 shattered previous benchmarks, with renewables accounting for the majority of new capacity.

This buildout supports an economy increasingly powered by electrons rather than hydrocarbons. Low electricity prices—enabled by scale and market reforms—encourage greater usage across sectors, from heavy industry to consumer EVs. China now generates more than twice as much electricity as the U.S., with clean sources comprising a growing share.

In stark contrast, the U.S. grapples with grid constraints exacerbated by surging AI-driven demand. Regulatory delays, permitting bottlenecks, and a policy focus on fossil fuels slow renewable scaling, leaving China with a clear edge in cheap, reliable power for high-energy applications.

Pillar 2: Critical Minerals – The New Geopolitical Oil

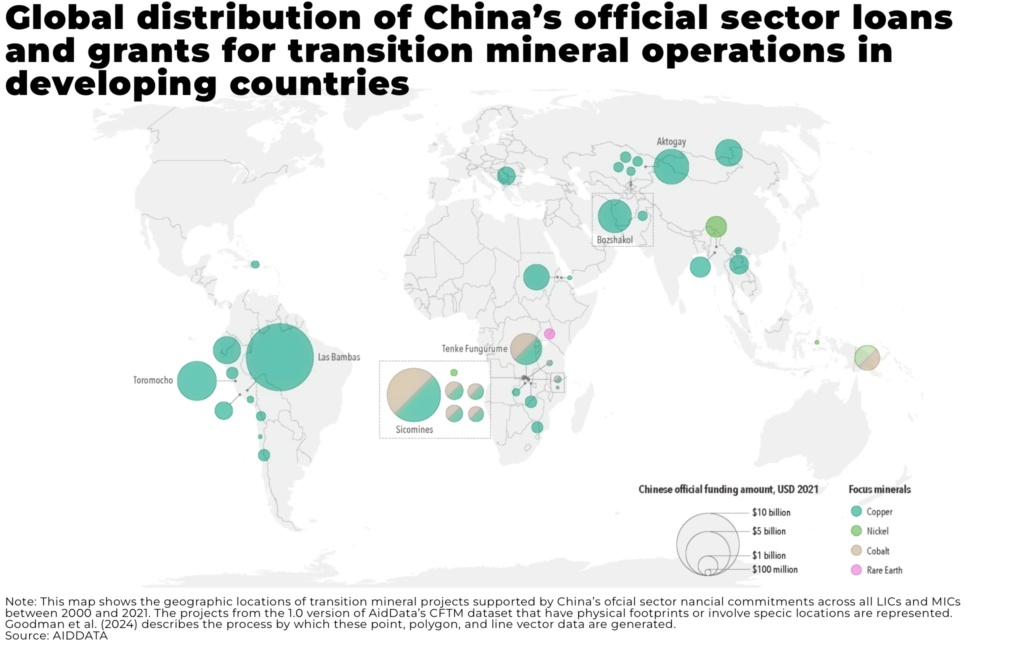

Electrification relies on raw materials, and here China holds unparalleled control. It processes over 70% of global lithium refining, dominates cobalt and graphite, and commands 60-70% of rare earth elements (essential for magnets in EVs, wind turbines, and defense tech). By 2030 projections, China is expected to supply over 60% of refined lithium and cobalt, and around 80% of battery-grade graphite and rare earths.

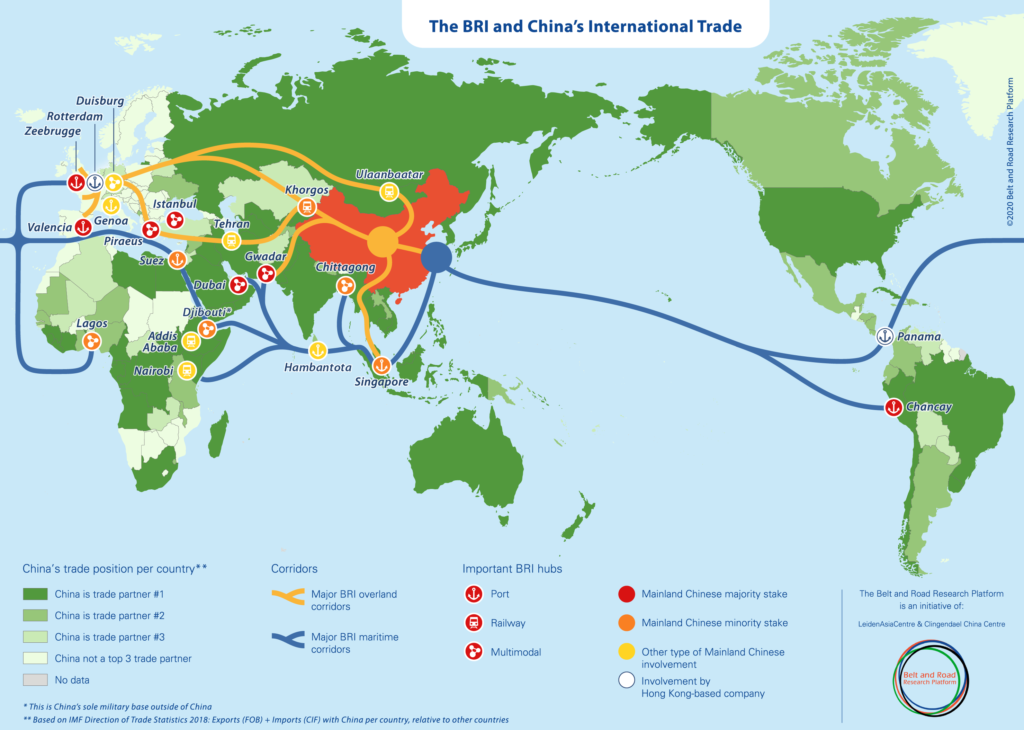

This dominance arises from vertical integration: massive domestic production, overseas investments via the Belt and Road Initiative (BRI) in Africa, Latin America, and beyond, and advanced refining infrastructure. Export controls on rare earths and processing tech—tightened in 2025 amid U.S. tensions—demonstrate leverage over global markets.

The U.S. and allies face vulnerabilities, with heavy reliance on Chinese chains despite efforts like the Inflation Reduction Act and friendshoring. Diversification remains slow, leaving Western industries exposed to supply disruptions or price manipulation.

Pillar 3: AI Deployment – Where Energy Meets Technological Supremacy

AI’s explosive growth demands vast compute power, and electricity is the bottleneck. China’s advantages—abundant cheap power, rapid grid expansion, and fewer regulatory hurdles—enable massive data center scaling. Forecasts show China’s data center electricity demand more than doubling by 2030, but its overall power generation (already twice the U.S.) and clean energy additions keep pace effortlessly.

Experts highlight this “electron gap”: China can build power infrastructure faster, supporting AI training and deployment at lower costs. Targets include widespread AI integration by 2027 and global leadership by 2030, fueling robotics, autonomous systems, and industrial applications.

The U.S., despite chip leadership, faces power shortages and grid strains from AI boom. Demand could double U.S. data center electricity use by 2030, but slower infrastructure growth risks ceding deployment speed to China.

Pillar 4: Outpacing the U.S. in Emerging Markets and Infrastructure Exports

China’s BRI has evolved into a “green” powerhouse, exporting affordable solar, EVs, batteries, and grid tech to the Global South. In 2025, BRI energy engagement hit record highs (~USD 93.9 billion), with green projects (wind, solar, waste-to-energy) reaching USD 18.3 billion and over 22 GW planned capacity—new highs since 2013. Cumulative BRI engagement surpassed USD 1.3 trillion, with clean energy filling vacuums left by Western hesitancy.

Two-thirds of emerging economies now surpass the U.S. in solar’s power generation share, largely due to Chinese tech. For Pakistan, CPEC integrates green upgrades—solar imports, renewable parks, and low-carbon industrial zones—offering affordable energy solutions amid domestic needs.

This strategy secures minerals, builds alliances, and expands influence, contrasting with U.S. tariffs and fossil emphasis.

Military Modernization: The Electrostate Goes to War

The September 3, 2025, Victory Day Parade—marking 80 years since WWII’s end—vividly linked electrostate strengths to military edge. The ~70-90 minute Beijing event featured ~12,000 troops and dozens of new systems, many debuting publicly.

Key showcases tied to electrostate pillars:

- Unmanned/AI systems: GJ-11 stealth drones, AJX002 giant submarine drone, robotic “electronic wolves,” autonomous attack drones (battery/AI-dependent).

- Directed energy: LY-1 high-power laser (disables electronics/blinds targets; energy-intensive but powered by abundant supply).

- Hypersonics/missiles: YJ-20 anti-ship (“Guam killer”), DF-61 ICBM, DF-5C variant (mineral-secure chains vital).

- Nuclear triad: Full display of land, sea (JL-3), air systems.

Attended by Putin and Kim Jong Un, the parade signaled “unstoppable rejuvenation” amid U.S. rivalry, proving electrification, minerals, and AI enable high-tech, energy-hungry forces—reshaping Indo-Pacific deterrence and regional security for nations like Pakistan.

Broader Implications: A Divided World Order

This trajectory creates a petrostate-electrostate divide: U.S./allies resisting transition versus China/Global South alignments. It accelerates decarbonization via cheaper renewables but fosters dependencies and supply risks.

For Pakistan/South Asia: Chinese tech offers affordable solutions and CPEC greening, but debt, U.S. tariffs, and military imbalances demand strategic navigation. The parade underscores shifting regional power.

Conclusion: Electrons Defining the Future

China’s electrostate is a deliberate strategy—electrons over hydrocarbons—fueling resilience, tech leadership, exports, and deterrence. The 2025 parade proved it: clean energy powers factories, data centers, and next-gen warfare.

As petrostates cling to yesterday’s fuel, China powers tomorrow’s world. Electrons—not oil—may decide the century’s winners. Watch closely: the electrostate era is here.