(By Khalid Masood)

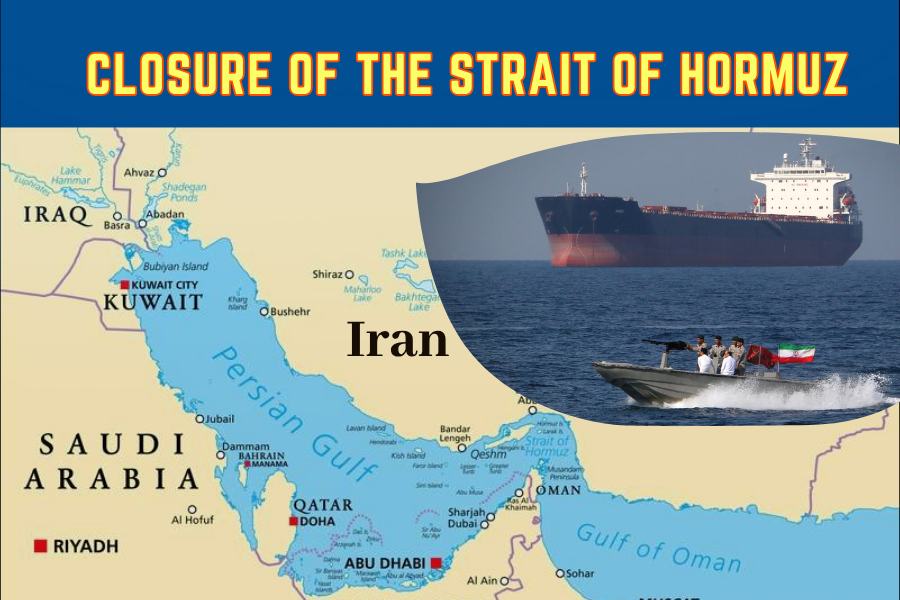

As Iran threatens to close the Strait of Hormuz amidst its intensifying conflict with Israel in June 2025, the world stands on the precipice of a potentially catastrophic disruption to global energy flows. The Strait, a narrow but vital maritime chokepoint, is not just a regional water-body – It is a jugular vein of the global economy, through which nearly 20% of the world’s oil supply flows daily. Iranian lawmaker Esmail Kosari’s declaration, reported by IRINN, is not mere rhetoric—it is a strategic warning backed by geography and leverage. Tehran is signaling that it holds a geopolitical pressure valve, one it can open or shut to destabilize markets, disrupt supply chains, and rattle superpowers.

For the rest of the world, particularly energy-hungry nations in Asia and the West, this threat is far more than regional saber-rattling—it is a potential trigger for global inflation, energy crises, and military confrontation. The Strait of Hormuz now looms as a high-stakes flashpoint where diplomacy, deterrence, and raw power intersect. What unfolds here in the coming weeks could reshape the balance of power, redraw strategic alliances, and ignite conflicts far beyond the waters of the Persian Gulf.

Location and Geopolitical Significance

Nestled between Iran’s southern coast and the northern shores of Oman and the United Arab Emirates, the Strait of Hormuz is the sole maritime gateway linking the Persian Gulf to the Gulf of Oman and the Arabian Sea, feeding into the Indian Ocean. At its narrowest point, the strait spans just 33 kilometers (21 miles), with shipping lanes a mere two miles wide in each direction, regulated by a Traffic Separation Scheme (TSS) under the UN’s International Maritime Organization. Its shallow waters, dotted with islands like Qeshm, and proximity to Iran’s 100-nautical-mile coastline make it a chokepoint vulnerable to military action. Unlike other bottlenecks, such as the Suez Canal, the strait has no viable maritime bypass, rendering it indispensable for Gulf oil exports.

The strait’s geopolitical weight stems from its role as the artery for oil-rich Gulf states—Saudi Arabia, Iraq, Kuwait, Qatar, and the UAE—whose exports fuel Asian giants like China, India, and Japan. Iran, too, relies on the strait for its oil terminals within the Gulf, tying its economy to this waterway. For Pakistan, a net oil importer navigating IMF constraints and South Asian rivalries, the strait’s stability is critical, as disruptions could echo the 1970s oil shocks, straining Islamabad’s energy-dependent economy. Iran’s historical claim, rooted in 2,500 years of Persian dominance, frames its actions as both sovereign defense and regional power projection, a stance Pakistan observes warily, given its own maritime security concerns in the Arabian Sea.

Importance and Daily Oil Tanker Flow

The Strait of Hormuz is the world’s preeminent oil chokepoint, carrying approximately 21 million barrels per day (b/d) of crude oil, condensate, and petroleum products in 2023, equivalent to 21% of global petroleum liquids consumption. This includes 80 million metric tons of liquefied natural gas (LNG), or 20% of global flows, primarily from Qatar, the world’s top LNG exporter. Saudi Arabia leads exports, followed by Iraq, the UAE, Kuwait, and Iran, with 82% of crude oil destined for Asian markets—China, India, Japan, and South Korea absorbing 67% of flows. The strait handles 14-17 tankers daily, each very large crude carrier (VLCC) ferrying about two million barrels, valued at $1.2 billion daily at 2019 prices.

For the global economy, the strait’s uninterrupted flow is non-negotiable. A 2007 Center for Strategic and International Studies report estimated that Hormuz accounts for 40% of world-traded oil, underscoring its outsized role. Alternative routes, like Saudi Arabia’s 5-million-b/d East-West pipeline or the UAE’s 1.5-million-b/d Fujairah pipeline, offer only 3.5 million b/d of bypass capacity, insufficient to offset a closure. Pakistan, reliant on Gulf imports for 80% of its oil, faces acute vulnerability, as price spikes could exacerbate inflation and fiscal deficits, mirroring regional neighbors like India. The strait’s chokehold on energy security thus binds global markets to its fate.

Iran’s Leverage to Close the Strait

Iran’s threat to close the Strait of Hormuz, voiced by Esmail Kosari in June 2025, leverages its geographic and military advantages. Iran’s coastline overlooks the strait for over 100 nautical miles, bristling with anti-ship missiles, drones, and shore batteries. The Islamic Revolutionary Guard Corps (IRGC) Navy, equipped with speedboats for swarm attacks and submarines for mining, could disrupt shipping through asymmetric tactics. During the 1980s Tanker War, Iran mined the Gulf, damaging tankers, and recent incidents—like the 2019 Fujairah attacks and 2023 seizures of the Panama-flagged Niovi—demonstrate its capacity for targeted harassment. Iran’s 1993 maritime law, claiming oversight of foreign warships, further emboldens its posturing, though it violates UNCLOS, which the U.S. contests.

Yet, a sustained closure is daunting. The strait’s 25-30-mile width, far wider than the Suez Canal’s 984 feet, complicates total blockades. Laying 1,000 mines, as suggested by a 2009 MIT study, would take weeks and invite U.S. retaliation, given the Fifth Fleet’s presence in Bahrain. Iran’s economy, dependent on the strait for 65% of government revenue from oil exports, risks collapse if flows halt, potentially sparking domestic unrest. From Pakistan’s vantage, Iran’s leverage mirrors its own strategic posturing in the Arabian Sea, but Tehran’s brinkmanship could backfire, alienating allies like China while galvanizing U.S.-led coalitions.

Implications for Global and Regional Powers

A closure of the Strait of Hormuz would unleash chaos across global energy markets. Analysts estimate oil prices could surge to $150-$350 per barrel, dwarfing the 1970s shocks, with a 3% supply cut from Iranian sanctions alone pushing prices above $100. Asian importers—China (world’s top oil consumer), India, Japan, and South Korea—would face fuel shortages, industrial slowdowns, and inflation, crippling economies. Europe, reliant on Gulf LNG, and the U.S., despite reduced imports (1.4 million b/d in 2018), would see pump prices soar, stoking recession fears. Strategic reserves could mitigate short-term shortages, but prolonged disruption would strain global supply chains, raising food and medical costs.

Regionally, Gulf states like Saudi Arabia, Iraq, Kuwait, and Qatar, which export 100% of their oil via Hormuz, would face economic paralysis, undermining OPEC’s clout. The UAE and Saudi Arabia’s pipelines offer partial relief, but Iraq and Kuwait lack alternatives, risking fiscal crises. For Pakistan, a closure would spike import costs, deepen energy poverty, and strain ties with Gulf allies, complicating its neutral stance in Iran-Saudi rivalries. Houthi attacks on the Bab al-Mandeb Strait, as seen since 2023, amplify risks, as dual chokepoint disruptions could paralyze 35% of global maritime trade, a scenario Pakistan dreads given its Gwadar port ambitions.

China’s Stance: Will It Allow Iran to Close the Strait?

As Iran’s largest oil buyer, accounting for over 75% of its exports, China holds significant sway over Tehran’s actions. Beijing’s reliance on Gulf oil—76% of Hormuz’s 2018 flows went to Asia, with China as a top destination—makes a closure catastrophic for its economy, which faces slowing growth in 2025. Analysts like Ellen Wald argue that China would exert economic pressure to deter Iran, as price spikes above $100 per barrel could derail its industrial output and Belt and Road ambitions. China’s 2023 mediation of the Saudi-Iran deal reflects its stake in Hormuz’s stability, positioning Beijing as a counterweight to U.S. dominance in the Gulf.

However, China’s alliance with Iran, cemented by joint naval drills and the Hormuz Peace Endeavour (HOPE), complicates its calculus. Beijing may tolerate limited Iranian disruptions to counter U.S. sanctions, but a full blockade would alienate Saudi Arabia and the UAE, key trade partners. For Pakistan, a CPEC partner, China’s balancing act mirrors Islamabad’s own tightrope walk between Iran and Gulf monarchies. While China’s economic leverage could restrain Iran, its strategic rivalry with the U.S. might temper outright opposition, leaving room for Tehran to test the strait’s limits, a prospect Pakistan monitors closely.

U.S. Response to a Closure

The U.S., viewing freedom of navigation as a vital interest, would respond swiftly to any Iranian attempt to close the Strait of Hormuz. The Fifth Fleet, based in Bahrain, is poised to counter Iran’s asymmetric tactics, with destroyers like USS Thomas Hudner, F-35 fighters, and F-16s deployed since 2023 to deter seizures. Pentagon statements emphasize defending “U.S. interests and safeguarding commerce,” backed by allied patrols under the International Maritime Security Construct. In 1987, U.S. escorts during the Tanker War neutralized Iranian mines, and experts like Suzanne Maloney assert the U.S. could reopen the strait “relatively quickly,” though not without cost.

A military response risks escalation, as Iran’s missiles and drones could target U.S. assets or Gulf infrastructure, as seen in 2019’s Abqaiq attack. Politically, a closure would spike U.S. gas prices, pressuring President Trump to act decisively, especially post-2025 inauguration. Sanctions tightening, as flagged by Reuters in 2023, could precede strikes on Iranian naval bases, though broader war is unlikely given Iran’s conventional inferiority. Pakistan, wary of U.S.-Iran clashes near its shores, would urge de-escalation, fearing refugee flows and trade disruptions, while quietly aligning with U.S.-Gulf security frameworks.

Broader Risks and Pakistan’s Perspective

Beyond oil, a Hormuz closure threatens global trade, as 20% of maritime commerce transits the strait. Food and medical supply disruptions could spark humanitarian crises in import-dependent states, including Pakistan, where 40% of food is imported. Iran’s domestic gamble—65% of its revenue hinges on oil exports—could ignite unrest if subsidies collapse, a scenario Israel might exploit to weaken Tehran’s regime, though at global cost. The strait’s closure, even briefly, would reshape alliances, with Russia and China potentially backing Iran’s “safe passage” for their vessels, as speculated on X, deepening great-power rivalries.

For Pakistan, the Strait of Hormuz is a double-edged sword. Its proximity to Gwadar, a CPEC hub, amplifies risks of spillover conflict, yet Iran’s leverage offers a hedge against India’s Chabahar port, backed by the U.S. Islamabad’s neutral stance, balancing Tehran, Riyadh, and Washington, would be tested, as a closure could derail CPEC trade and strain Gulf aid. Drawing on its oil supply chain expertise, Pakistan advocates for diplomacy, urging UN-led talks to secure Hormuz, while bolstering naval patrols with China to safeguard Arabian Sea routes. The strait’s fate, thus, is a litmus test for Pakistan’s statecraft in a fracturing world.

Conclusion: A Fragile Artery

The Strait of Hormuz—a slender ribbon of sea—holds the fate of the global economy in its tightening grasp. As Iran, emboldened by its escalating confrontation with Israel in 2025, threatens to choke off this critical artery, the world teeters on the edge of a crisis with cascading consequences. This is no idle provocation; it is a calculated move by Tehran to weaponize geography against the world’s dependence on Gulf oil. While Iranian missiles, fast-attack boats, and sea mines pose a real and present danger, the prospect of a prolonged closure is counterweighted by overwhelming U.S. naval dominance, mounting Chinese diplomatic pressure, and Iran’s own economic fragility.

Yet, even a temporary disruption—a single skirmish or sabotage—could spike oil prices to $150 per barrel, sending shockwaves through economies from Karachi to California, and plunging vulnerable nations into energy chaos. For Pakistan, whose energy lifeline runs through Hormuz, this is not just a regional issue—it is a matter of national survival. The strait now stands as a geostrategic fault line, where regional rivalries, global power plays, and economic dependencies collide. One miscalculation, one missile too many, and this chokepoint could ignite a chain reaction capable of reshaping the world order.