(By Khalid Masood)

In the first weeks of 2026, U.S. President Donald Trump has returned to the White House with an intensified version of his signature “America First” playbook. Tariff increases on long-standing allies such as South Korea, explicit threats of 100% tariffs against Canada over deepening economic links with China, and unusually blunt military rhetoric directed at Mexico and parts of Latin America have quickly created a sense of diplomatic turbulence.

At the same time, other major economies are visibly accelerating long-planned diversification strategies. The preliminary strategic trade understanding reached between China and Canada in mid-January, and the landmark EU–India Free Trade Agreement concluded on January 27 after nearly two decades of negotiations, illustrate how countries are hedging against U.S. policy volatility.

These contrasting developments raise a central question for the international system: Is the United States meaningfully diminishing as the world’s sole superpower and the principal architect of a unipolar order? While the U.S. continues to possess unmatched military reach, technological leadership in critical domains, and the unrivaled status of the dollar as global reserve currency, current policy choices appear to be accelerating a transition toward a strongly bipolar structure (U.S.–China) overlaid with increasingly assertive multipolar elements driven by middle powers.

This article examines the U.S. actions that are provoking the shift, the counter-moves already underway, the evidence for and against genuine structural decline in American primacy, and the likely implications of a more contested global order.

U.S. Trade Policies Under Trump: Protectionism and Coercion

Trump’s second term has revived protectionism at a pace and scope that exceeds even his 2017–2021 administration. Tariffs and trade threats are now openly used as geopolitical instruments — aimed not only at reducing bilateral deficits but also at enforcing alignment on security issues, investment flows, and opposition to China.

Tariff Hikes on Allies

On January 26, 2026, the administration announced an increase in tariffs on South Korean imports from 15% to 25%, targeting automobiles, lumber, pharmaceuticals, and several other product categories described as requiring “reciprocal” treatment. The decision reversed key elements of a July 2025 bilateral framework under which Seoul had committed to $350 billion in direct investments in the United States over the coming decade in exchange for significantly lower tariff rates.

South Korea’s response was swift: emergency cabinet-level meetings were convened, the ruling party pledged to fast-track ratification legislation by the end of February, and major automakers saw temporary share-price pressure amid fears of supply-chain disruption and higher end-consumer costs in the U.S. market. Industry estimates suggest the tariff hike could add several thousand dollars to the price of many imported vehicles and components — costs that would likely be passed on to American buyers and potentially affect jobs in U.S. assembly plants reliant on Korean parts.

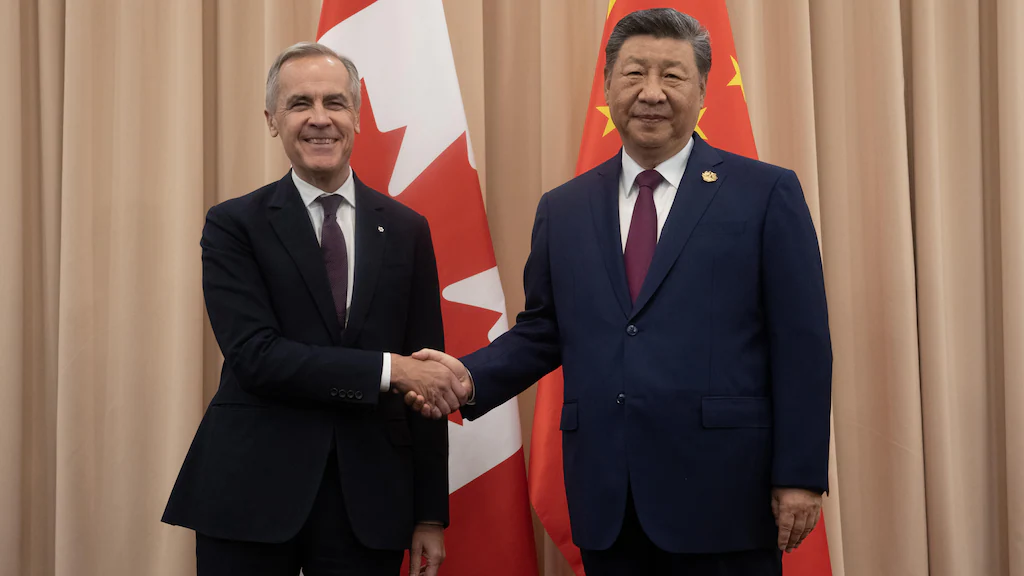

Parallel pressure has been directed at Canada. President Trump publicly threatened 100% tariffs across the board if Ottawa pursued closer economic integration with China, framing the issue in stark terms (“China will devour Canada”) and directing personal criticism at Prime Minister Mark Carney, whom he repeatedly called “Governor” on social media. These statements coincided with ongoing discussions about the 2026 review of the USMCA and persistent U.S. concerns over fentanyl trafficking routes.

Although Canadian officials emphasized that no comprehensive free-trade agreement with China was under negotiation, the episode reinforced broader U.S. demands for tighter alignment on security and economic issues. Similar — though less intense — tariff warnings have been directed toward the European Union (initially linked to Denmark’s refusal to discuss the future status of Greenland), though that particular dispute was quickly de-escalated.

Invasion Rhetoric Toward Mexico and Latin America

Beyond trade measures, the administration has employed unusually direct military language toward Mexico and parts of Latin America. President Trump has repeatedly suggested that decisive action — including possible airstrikes, special-operations missions, or broader intervention — may be necessary to disrupt Mexican drug cartels responsible for much of the fentanyl entering the United States. The phrase “something’s going to have to be done” has been repeated in public remarks and interviews.

This rhetoric follows the high-profile January 1, 2026, U.S. operation in Venezuela that resulted in the capture of President Nicolás Maduro, an action justified primarily by the need to secure oil production and stabilize a strategically important neighbor. While a full-scale invasion of Mexico remains politically and logistically improbable, the open discussion of military options has unsettled governments across the hemisphere and revived memories of earlier U.S. interventions (Panama 1989, Grenada 1983, multiple Central American operations during the Cold War).

Broader Context and Economic Impacts

These policies are consistent with the long-standing Trump goal of reducing chronic U.S. trade deficits and bringing manufacturing capacity back onshore. Yet they carry substantial short- and medium-term risks: inflationary pressure on American households, retaliatory tariffs from affected trading partners, supply-chain fragmentation, and — perhaps most importantly — cumulative damage to perceptions of U.S. reliability as an economic partner.

Some European capitals have quietly begun internal discussions about accelerating the repatriation of gold reserves currently held in U.S. vaults — a symbolic but telling indicator of unease about the potential weaponization of dollar-based financial infrastructure.

These increasingly unilateral and coercive actions are not going unnoticed. Several major economies are already responding by accelerating long-standing diversification strategies and building alternative economic relationships — moves that were already underway but have gained new urgency in early 2026.

Emerging Global Partnerships as Hedges Against U.S. Volatility

China–Canada Strategic Partnership

On January 16, 2026, during Prime Minister Mark Carney’s visit to Beijing, Canada and China announced a preliminary “agreement-in-principle” designed to resolve several long-standing bilateral irritants. While explicitly not a full free-trade agreement, the understanding delivers meaningful commercial relief and opens doors for future cooperation.

Key elements include:

- Energy sector collaboration — joint development of conventional oil and gas resources, investment in clean-energy technologies (notably offshore wind), and support for Canada’s plan to roughly double national electrical grid capacity over the next 15 years. Chinese capital and engineering expertise are expected to play a significant role.

- Agricultural market access — China agreed to reduce tariffs on Canadian canola seed to approximately 15% by March 1, 2026 (down from 84–85%), with additional relief extended to canola meal, lobsters, crabs, peas, and several other categories. The combined relief is estimated to unlock roughly CAD 6.6 billion in annual export opportunities, with some measures applied retroactively to January 1.

Canada, in turn, committed to applying a preferential 6.1% tariff rate to a capped volume of Chinese electric vehicles (up to 49,000 units per year). Both sides pledged to restart regular high-level economic dialogues and facilitate two-way investment in energy and clean-tech projects.

Prime Minister Carney described the arrangement as necessary adaptation to “new global realities,” while Chinese officials stressed that the understanding was not aimed at any third party. Despite the preceding U.S. tariff threats, Ottawa chose to proceed — a clear signal of strategic recalibration.

EU–India Landmark Free Trade Agreement

On January 27, 2026, at a summit in New Delhi, the European Union and India formally concluded negotiations on a comprehensive Free Trade Agreement — frequently described by leaders on both sides as “the mother of all deals.”

After 18–20 years of intermittent talks (suspended in 2013 and revived in 2022), the pact creates one of the world’s largest preferential trade zones, encompassing roughly two billion people and about 25% of global GDP.

Principal features include:

- Very broad tariff elimination / reduction — duties removed or sharply lowered on 90–96% of current EU exports to India, delivering an estimated €4 billion in annual savings for European companies. Key reductions cover machinery (up to 44%), chemicals (22%), pharmaceuticals (11%), and phased cuts on automobiles (eventual 10% rate), wines, beers, and selected food products.

- Market openings for India — improved access for textiles, agricultural products, services, and gems & jewelry. Sensitive agricultural sectors were largely excluded to address domestic political sensitivities.

- Supporting commitments — €500 million in EU climate-finance support for India’s green-energy transition, streamlined investment procedures, and mutual recognition in selected professional services.

Formal ratification by the European Parliament, Council, and Indian authorities is expected to take several months, with implementation targeted for 2027. Geopolitically, the agreement bolsters post-Brexit EU outreach to Asia and reinforces India’s multi-alignment doctrine — allowing New Delhi to deepen ties with both Western and non-Western partners while avoiding exclusive dependence on any single pole.

Whether these developments actually signal meaningful decline in U.S. primacy remains hotly debated.

Is the U.S. Diminishing as the World’s Sole Superpower?

Historical Context

The unipolar moment that followed the end of the Cold War — a period in which the United States faced no peer competitor and enjoyed decisive advantages in military projection, economic weight, technological innovation, and normative influence — has been gradually eroding since the mid-2000s. China’s extraordinary economic ascent (now widely projected to surpass U.S. GDP in market-exchange terms sometime between 2027 and 2030) fundamentally changed the distribution of power. Most serious analysts now describe the contemporary system as bipolar at its core (U.S.–China), with important multipolar characteristics created by the growing autonomy of middle powers (India, the EU as a collective actor, Brazil, Indonesia, Saudi Arabia, and others).

Evidence of Erosion

Several measurable indicators point to relative — though not absolute — decline in U.S. centrality:

- Economic share — The U.S. share of global GDP (market exchange rates) has fallen from roughly 32% in the early 2000s to about 24–25% today, while China’s has risen to approximately 18–19% and continues to grow rapidly.

- Military spending — Although the U.S. still accounts for roughly 38–40% of worldwide defense expenditure, China’s absolute spending has increased faster than any other major power over the past decade.

- Technological leadership — While the U.S. maintains clear advantages in frontier AI models, advanced semiconductor design, and certain quantum domains, China has closed gaps dramatically in 5G infrastructure, battery technology, rare-earth processing, and patent filings in strategic fields.

- Soft power and diplomatic trust — Repeated surveys (Pew Research, Chicago Council on Global Affairs) show declining confidence in U.S. leadership across much of the Global South and even among some traditional allies — a trend that has been exacerbated by perceptions of erratic policy-making.

Trump-era policies risk accelerating these trends by alienating partners who might otherwise have remained firmly inside the U.S.-led order.

Counterarguments — Enduring U.S. Strengths

Despite the above indicators, claims of imminent collapse are premature:

- The U.S. retains by far the most extensive network of overseas military bases and the only truly global power-projection capability.

- Alliance systems (NATO, AUKUS, Quad, bilateral defense pacts across Asia) remain intact and, in several cases, have been strengthened (many European NATO members now meet or approach the 2% GDP defense-spending target).

- The dollar continues to dominate international invoicing, foreign-exchange reserves, and cross-border payments; meaningful de-dollarization remains a slow, incremental process.

- U.S. export controls on advanced semiconductors and AI-related technologies have demonstrated continuing ability to impose asymmetric costs on strategic competitors.

- The speed and scale with which Washington assembled maritime-security coalitions in the Red Sea and Gulf of Aden in 2024–2025 illustrate that coalition-building capacity is still unmatched.

In short, while relative power is shifting, the United States remains the only actor capable of exercising truly global influence across all domains simultaneously.

If these trends represent more than temporary friction — if they are symptoms of genuine structural erosion in U.S. centrality — then the international system is likely entering a more contested and fluid phase. What might such a multipolar (or strongly bipolar) world look like?

Implications for Global Multipolarity

Acceleration of Bipolarity with Multipolar Elements

The dominant long-term dynamic remains intense U.S.–China strategic rivalry, with each power consolidating spheres of influence (the U.S. in much of the Western Hemisphere and across the Atlantic and Pacific alliances; China across large parts of continental Asia and growing swathes of the Global South). At the same time, middle powers are carving out greater autonomy, creating a layered system that is bipolar at the apex but multipolar in its day-to-day operation.

Risks

A more fragmented order carries real dangers:

- Heightened risk of miscalculation in flashpoints (Taiwan Strait, South China Sea, Korean Peninsula, Red Sea maritime chokepoints).

- Proliferation of regional spheres where great-power competition is conducted through proxies or economic coercion rather than direct confrontation.

- Erosion of universal norms and institutions — recent events illustrate the point: the U.S. abduction of Nicolás Maduro in Venezuela (January 2026) may have secured short-term oil interests but simultaneously strengthened China’s narrative of U.S. imperialism, pushing more Latin American governments toward hedging or non-alignment.

Opportunities

The same fluidity also opens possibilities:

- Greater space for “re-globalization” initiatives led from the Global South and middle powers, reducing exclusive dependence on either U.S. or Chinese rules.

- The EU–India FTA itself is a case in point: by creating a large-scale trade bloc outside the U.S.–China axis, it demonstrates how middle powers can cooperate on climate finance, digital standards, supply-chain resilience, and green-technology deployment without waiting for superpower permission.

- Non-alignment and multi-alignment strategies empower smaller and medium-sized states to extract better terms from competing suitors.

Future Scenarios

Three broad trajectories are plausible:

- U.S. course correction — renewed emphasis on alliance management, economic statecraft that is less punitive toward partners, and selective tactical cooperation with China on shared threats (climate, pandemics, AI safety) — could stabilize a still U.S.-tilted bipolarity.

- Continued unilateral drift — deepening alienation of allies and accelerated diversification by middle powers could produce a “silent recessional” in which U.S. influence wanes through disuse rather than decisive defeat.

- Managed multipolarity — pragmatic deal-making among the major poles and middle powers could yield a more distributed but functional order, albeit one with higher transaction costs and greater risk of regional breakdowns.

Conclusion

The contrast between Trump’s current trade aggressions and coercive diplomacy on one hand, and the simultaneous emergence of resilient alternative partnerships on the other, marks an important inflection point. The United States is not collapsing — its core strengths remain formidable — but appears to be hastening its own relative decline through self-inflicted alienation of partners who might otherwise have stayed firmly within the U.S.-led system.

The real question for 2026 and beyond may not be whether unipolarity is definitively over, but whether Washington can adapt to a world it no longer dominates alone — and whether the rest of the international community can navigate the transition without catastrophic conflict. For policymakers the task is clear: repair alliance trust and use economic statecraft more surgically. For businesses the imperative is equally straightforward: diversify supply chains and build redundancy against geopolitical volatility. The decade ahead will be defined by how skillfully all actors manage this contested but potentially more pluralistic global order.