(By Faraz Ahmed)

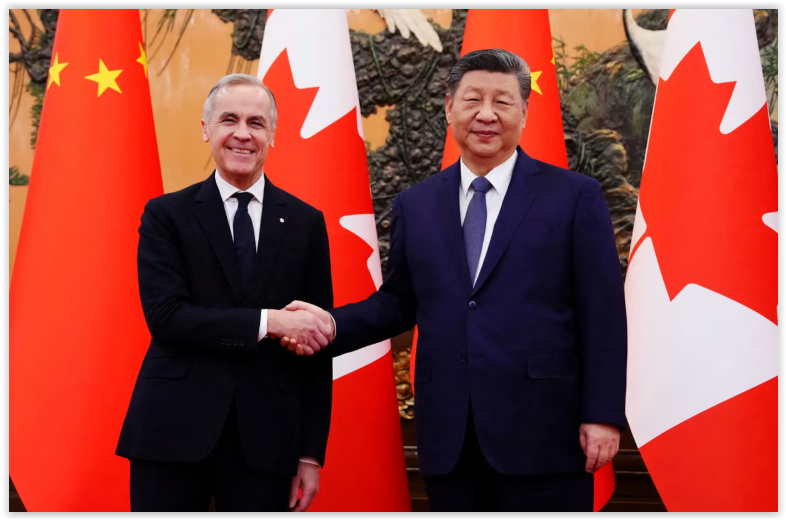

In the space of just one week in mid-January 2026, three prominent Western leaders delivered powerful endorsements of closer ties with China, marking what many observers are calling a diplomatic hat-trick for Beijing. Canadian Prime Minister Mark Carney completed a landmark visit to Beijing from January 14–17, emerging with a new strategic partnership that slashes tariffs and opens doors to massive trade gains. On January 20, French President Emmanuel Macron took the stage at the World Economic Forum in Davos to declare “China is welcome” and explicitly call for surging Chinese foreign direct investment (FDI) across key European sectors. That very same day, the United Kingdom government finally approved plans for China’s enormous new “mega-embassy” in central London—its largest diplomatic outpost in Europe—clearing a major obstacle for Prime Minister Keir Starmer’s planned trip to Beijing later in the month.

These synchronized developments are no coincidence. They reflect a growing realization among Western capitals that China offers reliability, economic opportunity, and mutual respect in an era when U.S. President Donald Trump’s aggressive, unpredictable “America First” agenda is alienating longtime allies. Trump’s barrage of tariffs—hitting Canada on steel and lumber, threatening sweeping levies on multiple European nations over the Greenland dispute, and maintaining high walls against Chinese goods—has created widespread frustration. His territorial demands on Greenland, framed as national security necessities but widely seen as coercive bullying, have pushed allies to seek alternatives. Beijing, by contrast, has responded with pragmatic concessions, tariff relief, investment invitations, and diplomatic warmth. The tide is unmistakably turning: Western nations are gravitating toward China’s model of win-win cooperation rather than enduring America’s unilateral demands.

The Broader Geopolitical Backdrop: Trump’s Isolationism Creates Space for China

Trump’s second term has been defined by escalation rather than engagement. In early January 2026, he renewed threats to acquire Greenland—citing the need to counter supposed Chinese and Russian influence in the Arctic—while vowing escalating tariffs (starting at 10% and rising to 25%) on Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and the United Kingdom unless they complied. These moves, announced via Truth Social and public statements, triggered emergency EU consultations, invocations of the bloc’s “trade bazooka” anti-coercion instrument, and sharp rebukes from leaders like Macron, who described U.S. tactics as “fundamentally unacceptable” and a violation of sovereignty.

The fallout has been immediate and severe. Transatlantic trust has eroded, supply chains face renewed disruption, and middle powers feel squeezed between American coercion and the need for economic stability. China has seized this opening masterfully. With its enormous domestic market, leadership in green technologies like electric vehicles (EVs), and consistent emphasis on multilateralism and shared development, Beijing presents itself as the adult in the room—predictable, respectful, and focused on tangible benefits rather than threats.

This January cluster demonstrates Beijing’s diplomatic agility: offering targeted relief to Canadian farmers and manufacturers, inviting European investment to rebalance trade, and facilitating symbolic breakthroughs like the UK embassy approval. As one analyst noted amid the Davos discussions, Trump’s actions are inadvertently “making China great again” by driving partners toward more constructive alternatives.

Canada’s Bold Reset – A Landmark Partnership Delivering Real Wins

Canada’s relationship with China had been frozen for years due to past diplomatic spats, U.S.-aligned EV tariffs, and security concerns. Prime Minister Mark Carney’s visit—the first by a Canadian leader since 2017—shattered that impasse and produced concrete, mutually beneficial results.

The centerpiece is a “new strategic partnership” spanning energy (both clean and conventional), agri-food, and broader trade. Key deliverables include:

- Canada opening its market to up to 49,000 Chinese-made EVs annually at the most-favored-nation rate of just 6.1% (a dramatic reduction from the 100% duties imposed in 2024 in lockstep with the U.S.). The quota is expected to grow roughly 6% per year, potentially reaching 70,000 vehicles within five years, with a focus on affordable models priced under $35,000 CAD. Crucially, Carney secured expectations of Chinese joint-venture investments in Canadian auto and EV supply chains—promising job creation and technology transfer.

- Reciprocal relief for Canadian exporters: China agreed to lower tariffs on canola seed to approximately 15% (from 84–85%) by March 1, 2026, and to remove anti-dumping duties on canola meal, lobsters, crabs, and peas at least through the end of 2026. These measures directly aid Canadian farmers hit hard by previous barriers.

- Supporting measures: Visa facilitation for Canadian tourists, tourism promotion agreements, and revival of the Joint Economic and Trade Commission.

Carney described the outcomes as positioning Canada for “the world as it is, not as we wish it,” and explicitly called relations with China “more predictable” than with the U.S. under Trump. This reset diversifies away from over-reliance on America, protects jobs, lowers costs for consumers, and attracts investment—classic benefits of pragmatic engagement with Beijing.

This January 2026 cluster is likely pragmatic and reversible, hinging on U.S.-China dynamics, deal implementation, and domestic politics. It accelerates trends toward multipolarity, where middle powers assert autonomy through selective engagement.

In a post-American-dominant order, such recalibrations may become more common—balancing competition with necessary cooperation. Whether they foster genuine multipolar stability or deepen dependencies remains to be seen, but they underscore that economic pragmatism now often trumps ideological alignment.

This January 2026 cluster is likely pragmatic and reversible, hinging on U.S.-China dynamics, deal implementation, and domestic politics. It accelerates trends toward multipolarity, where middle powers assert autonomy through selective engagement.

In a post-American-dominant order, such recalibrations may become more common—balancing competition with necessary cooperation. Whether they foster genuine multipolar stability or deepen dependencies remains to be seen, but they underscore that economic pragmatism now often trumps ideological alignment.

France’s Warm Welcome – Macron Champions Chinese Investment at Davos

Macron’s January 20 Davos address was a masterclass in strategic clarity. Facing U.S. tariffs, Greenland-related coercion, and domestic growth pressures, he rejected confrontation in favor of cooperation.

Key excerpts from his speech:

- “China is welcome, but what we need is more Chinese foreign direct investments in Europe, in some key sectors, to contribute to our growth, to transfer some technologies, and not just to export towards Europe some devices or products which sometimes don’t have the same standards, or are much more subsidized.”

- He contrasted this with U.S. “bullying,” preferring “respect to bullying” and “rule of law to brutality.”

- Macron urged Europe to activate tools like the anti-coercion instrument against American pressure while building balanced ties with China through on-the-ground investment and tech sharing.

China’s Foreign Ministry responded enthusiastically, highlighting mutual benefits and fair treatment for investors. Macron’s call aligns with Europe’s push for strategic autonomy: harnessing Chinese capital and innovation to fuel recovery, counter subsidy distortions through localization, and reduce vulnerability to U.S. whims. It’s a vote of confidence in China’s economic model and a clear pivot toward deeper partnership.

Britain’s Forward Step – Embassy Approval Unlocks Broader Engagement

After years of delays fueled by espionage fears and domestic opposition, the UK government—via Housing Secretary Steve Reed—approved China’s plans for a 20,000-square-meter “mega-embassy” at Royal Mint Court near the Tower of London on January 20. This complex, potentially China’s largest in Europe, had been stalled since China purchased the site in 2018.

Security assessments concluded risks were “manageable” with conditions in place. Critics decried it as a security compromise, but the decision is widely viewed as a deliberate signal to facilitate economic dialogue.

Most importantly, it removes a major hurdle for Prime Minister Keir Starmer’s forthcoming Beijing visit—likely late January 2026, accompanied by business leaders. This would be the first UK PM trip to China since 2018. Starmer has emphasized building a “consistent, durable, respectful” relationship to drive post-Brexit trade growth, investment, and stability. The embassy approval symbolizes Britain’s pragmatic choice: prioritizing economic opportunity with China over lingering Cold War-era suspicions.

Common Threads: Why the West is Turning Toward China

The unifying factor across these cases is Trump’s stubbornness. His tariffs, Greenland threats, and coercive style have made the U.S. an unreliable partner, prompting diversification:

- Canada gains export relief and manufacturing investment.

- France secures FDI and tech transfer to bolster growth.

- The UK unlocks trade dialogue and symbolic goodwill.

Beijing’s response—targeted concessions, openness to investment, and diplomatic facilitation—highlights the appeal of its win-win approach over America’s zero-sum demands.

Risks and Reality: Pragmatism Outweighs Outdated Fears

Skeptics raise concerns about security, influence, or over-dependence, but these are often overstated. Quotas, joint ventures, and conditions mitigate risks, while gains—jobs, affordable tech, export markets, and predictability—are immediate and substantial. In a multipolar world, managed engagement with China is smart statecraft.

Conclusion: China Rising as the Reliable Global Partner

This January 2026 cluster is likely pragmatic and reversible, hinging on U.S.-China dynamics, deal implementation, and domestic politics. It accelerates trends toward multipolarity, where middle powers assert autonomy through selective engagement.

In a post-American-dominant order, such recalibrations may become more common—balancing competition with necessary cooperation. Whether they foster genuine multipolar stability or deepen dependencies remains to be seen, but they underscore that economic pragmatism now often trumps ideological alignment.