(By Khalid Masood)

Introduction

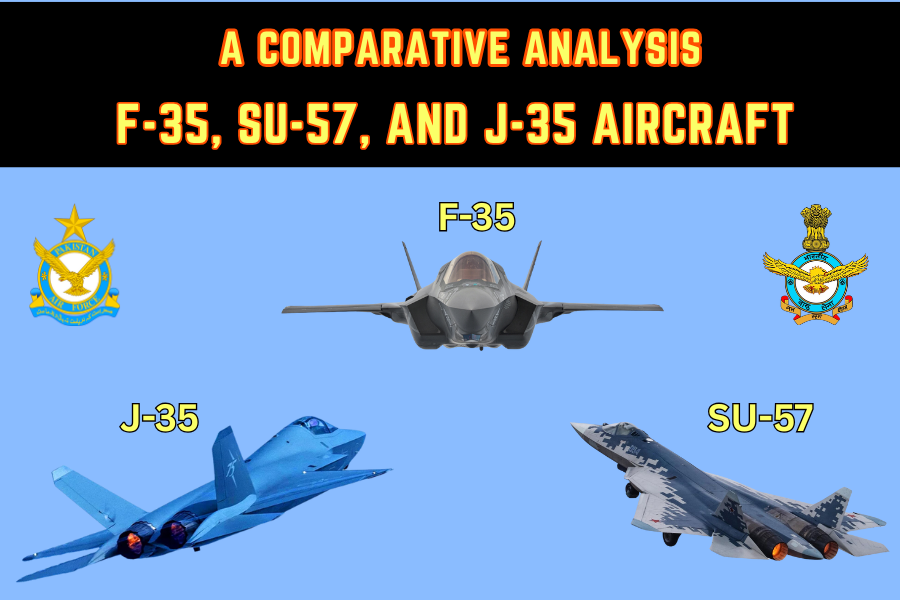

In the evolving landscape of modern warfare, fifth-generation stealth fighter jets represent the pinnacle of air combat technology, blending low observability, advanced avionics, and multirole capabilities. For instance, the U.S. F-35 Lightning II, Russia’s Su-57 Felon, and China’s J-35 (also known as FC-31) dominate discussions as India and Pakistan seek to modernise their air forces to counter regional threats. Specifically, the Indian Air Force (IAF), grappling with a shrinking fleet of 31 squadrons against a sanctioned 42, faces pressure from China’s J-20 expansion and Pakistan’s J-35 acquisition plans. Similarly, the Pakistan Air Force (PAF), bolstered by Chinese ties, aims to induct the J-35 but faces geopolitical barriers to accessing Western options like the F-35. Consequently, both nations confront complex decisions, balancing cost, capability, and strategic alignment. This article provides an in-depth analysis of the F-35, Su-57, and J-35, comparing their characteristics, maintenance costs, and suitability for the IAF and PAF, while offering viable interim options to bridge the stealth gap until indigenous or optimal solutions are available.

Historical Context

The quest for fifth-generation stealth fighters emerged from the need to dominate contested airspace in an era of advanced radar and missile systems. For example, the U.S. pioneered stealth with the F-22 Raptor, followed by the F-35, designed as a multirole platform for global allies. Russia’s Su-57, developed under the PAK FA programme since 1999, aimed to counter Western dominance, while China’s J-35, initially a private venture by Shenyang Aircraft Corporation, evolved into a naval and export-focused stealth jet. In South Asia, India and Pakistan’s rivalry, marked by conflicts like the 2025 Operation Sindoor, underscores the urgency of acquiring stealth capabilities. For instance, India’s IAF, reliant on ageing Soviet-era MiG-21s and Su-30MKIs, faces a “stealth gap” as China targets 1,000 J-20s by 2030 and Pakistan pursues 30–40 J-35s. Similarly, Pakistan’s PAF, equipped with JF-17s and F-16s, seeks to counter India’s Rafales and potential stealth acquisitions. Thus, the F-35, Su-57, and J-35 represent critical options, each shaped by distinct design philosophies and geopolitical realities.

Detailed Comparison of F-35, Su-57, and J-35

F-35 Lightning II

The Lockheed Martin F-35 Lightning II, developed under the Joint Strike Fighter (JSF) programme, is a family of single-seat, single-engine, fifth-generation multirole fighters. For instance, its three variants—F-35A (conventional takeoff), F-35B (short takeoff/vertical landing), and F-35C (carrier-based)—offer versatility for air-to-air, air-to-ground, and intelligence missions. Specifically, the F-35’s radar cross-section (RCS) of 0.001–0.005 m², roughly the size of a golf ball, is achieved through precise airframe geometry, S-shaped intakes, and radar-absorbent coatings. Moreover, its AN/ASQ-239 Barracuda electronic warfare system jams enemy sensors, while 360-degree cameras and advanced avionics, described by General David Goldfein as “a computer that flies,” enable unmatched situational awareness. The F-35’s armament includes internal bays for stealthy carriage of AIM-120 and AIM-9X missiles, with a 5,700 kg payload capacity. However, its single Pratt & Whitney F135 engine limits speed to Mach 1.6, and it lacks thrust-vectoring, reducing manoeuvrability compared to twin-engine designs.

Su-57 Felon

Russia’s Sukhoi Su-57, developed since 1999, is a twin-engine, multirole stealth fighter emphasizing “functional stealth” over absolute low observability. For example, its RCS, estimated at 0.1–1 m², is 20–200 times larger than the F-35’s, due to less optimised aft fuselage shaping and cost-driven design compromises. Nevertheless, the Su-57 excels in supermanoeuvrability, with thrust-vectoring AL-51F-1 engines enabling complex aerial manoeuvres and speeds up to Mach 2. Additionally, its K-77M and R-37M missiles offer beyond-visual-range (BVR) dominance, and integration with S-70 Okhotnik drones enhances its “loyal wingman” capability. However, production is limited—only 22 units by 2024—and combat experience is minimal, with unconfirmed reports of two Su-57s damaged in Ukraine. The export Su-57E, offered to India with source code access, aligns with India’s “Make in India” initiative but faces reliability concerns due to Russia’s after-sales support issues.

J-35 (FC-31)

China’s Shenyang J-35, initially the FC-31, is a twin-engine, fifth-generation stealth fighter designed for export and naval operations. For instance, its RCS, while not publicly disclosed, is reduced through internal weapons bays, serrated nozzles, and radar-absorbent materials, likely approaching the Su-57’s 0.1 m² range. Powered by WS-13 engines (with WS-19 upgrades planned), the J-35 reaches Mach 1.8 and aims for supercruise capability. Its multirole design supports PL-17 BVR missiles and a 2,000 kg internal payload, expandable to 8,000 kg externally. However, its development, only recently endorsed by the PLA, lags behind the F-35, with initial operational capability expected by 2026. Pakistan’s reported acquisition of 30–40 J-35s, though denied by Defence Minister Khawaja Asif, signals China’s push to compete with Western platforms, offering a cost-effective alternative for non-NATO nations.

Comparative Technical Analysis

- Stealth: The F-35 leads with its near-invisible RCS (0.001–0.005 m²), followed by the J-35 (estimated 0.1 m²) and Su-57 (0.1–1 m²). The F-35’s integrated stealth design, using advanced coatings and electronic countermeasures, outperforms the Su-57’s frontal-focused stealth and the J-35’s evolving capabilities. However, the Su-57’s partial stealth is sufficient within Russia’s defensive doctrine, relying on ground-based air defenses.

- Manoeuvrability: The Su-57’s thrust-vectoring engines and Mach 2 speed outshine the F-35’s Mach 1.6 and limited agility. The J-35, with planned WS-19 engines, aims for supercruise but lacks thrust-vectoring, placing it between the two. For instance, India’s Himalayan terrain and Pakistan’s border skirmishes demand agility, giving the Su-57 an edge.

- Avionics and Sensors: The F-35’s AN/ASQ-239 and 360-degree sensor suite provide superior situational awareness, enhanced by NATO interoperability. The Su-57’s N036 AESA radar and AI-assisted systems are potent but less proven, while the J-35’s avionics, still maturing, lag behind. Consequently, the F-35 excels in networked warfare, critical for both nations’ complex threat environments.

- Payload and Versatility: The Su-57 and J-35, with twin engines, offer larger payloads (10,000 kg and 8,000 kg, respectively) than the F-35 (5,700 kg). However, the F-35’s internal bays ensure stealthy strikes, unlike the Su-57 and J-35, which rely on external mounts for heavier loads, compromising stealth.

Maintenance Costs and Operational Challenges

Maintenance costs are a critical factor for resource-constrained air forces like the IAF and PAF. For instance:

- F-35: The F-35’s per-hour flight cost is approximately $40,000, driven by its complex stealth coatings, advanced avionics, and maintenance-intensive systems. The U.S. Government Accountability Office (GAO) estimates a $2 trillion lifecycle cost over 66 years, with a 55% mission-capable rate in 2023 due to spare parts shortages and engine issues. Specifically, 30 hours of maintenance per flight hour, coupled with 10,000 spare parts backlogged, limits availability.

- Su-57: The Su-57’s maintenance cost is estimated at $15,000–$20,000 per flight hour, reflecting Russia’s simpler design philosophy. However, its low production (22 units by 2024) and lack of combat testing raise reliability concerns. For example, shoddy production quality and Russia’s poor after-sales support, as experienced with India’s Su-30MKIs, pose risks.

- J-35: While exact costs are unavailable, the J-35’s estimated $10,000–$15,000 per flight hour reflects China’s focus on affordability. Its twin-engine design and newer systems suggest moderate maintenance demands, but limited operational data and reliance on evolving WS-19 engines raise uncertainties. Pakistan’s experience with JF-17s suggests China’s support is reliable but less sophisticated than Western standards.

Consequently, the F-35’s high costs and maintenance complexity challenge both nations’ budgets, while the Su-57 and J-35 offer affordability but risk reliability and performance gaps.

Suitability for India and Pakistan

Indian Air Force

India’s IAF, operating 31 squadrons against a sanctioned 42, faces threats from China’s J-20 fleet and Pakistan’s potential J-35 acquisition. For instance, the IAF’s ageing Su-30MKIs and MiG-21s struggle against modern stealth threats, and its indigenous Advanced Medium Combat Aircraft (AMCA) won’t enter service until 2035–2036. The F-35 offers unmatched stealth and avionics but faces hurdles: its $82.5–$110 million unit cost and $40,000 per-hour cost strain India’s defence budget, already stretched by Rafale purchases. Moreover, U.S. refusal to share source code or co-production rights clashes with Modi’s “Make in India” initiative, and end-user monitoring raises sovereignty concerns. The Su-57, at $35–$40 million per unit and with source code access, aligns with India’s self-reliance goals and integrates with existing Russian systems. However, its limited production, unproven combat record, and Russia’s sanctions-related supply issues deter adoption. The J-35, while cost-effective at $70 million, is unlikely due to India’s rivalry with China and concerns over reverse-engineering risks. Thus, India’s diverse terrain and two-front threat require a balance of stealth, affordability, and local integration, making the Su-57 a pragmatic but risky choice.

Pakistan Air Force

Pakistan’s PAF, equipped with JF-17s and F-16s, seeks to counter India’s Rafales and potential stealth acquisitions. For example, reports of a 30–40 J-35 deal, though unconfirmed, align with Pakistan’s deep Chinese ties via CPEC and prior JF-17 success. The J-35’s $70 million unit cost and $10,000–$15,000 per-hour cost fit Pakistan’s budget, and its stealth and multirole capabilities enhance deterrence against India. However, its developmental stage and unproven systems pose risks, especially in high-intensity conflicts. The F-35 is unattainable due to U.S. export controls, given Pakistan’s Chinese alignment and nuclear proliferation history. Similarly, the Su-57 is unlikely, as Russia prioritises India and lacks export infrastructure for Pakistan. Consequently, the J-35 is Pakistan’s most viable option, leveraging China’s reliable support, though its immaturity demands interim solutions.

Viable Interim Options

Both nations face delays in acquiring or developing stealth fighters, necessitating interim solutions to bridge the gap.

India

- Expand Rafale Fleet: The IAF’s 36 Rafales, proven in Operation Sindoor, offer 4.5-generation capabilities with low RCS and advanced AESA radars. Ordering 114 more under the Multi-Role Fighter Aircraft (MRFA) programme, with technology transfer, aligns with “Make in India” and counters immediate threats. Cost: $20 billion.

- Accelerate Tejas Programme: The indigenous Tejas Mark 1A (83 ordered, 97 planned) and Mark 2 provide agile, multirole platforms. Fast-tracking deliveries, despite delays, bolsters squadron strength. Cost: $5–7 billion for 180 units.

- AMCA Development Push: Investing $2 billion annually to expedite AMCA prototypes (targeted for 2028–2029) ensures a long-term stealth solution, leveraging Su-57 technology if acquired.

Pakistan

- Enhance JF-17 Block III: Upgrading JF-17s with AESA radars and PL-15 missiles improves BVR capabilities. Cost: $2–3 billion for 50 upgraded units, leveraging existing Chinese support.

- Procure J-10C: Acquiring 36–50 J-10C fighters, proven in Operation Sindoor, offers 4.5-generation performance with low RCS and WS-10 engines. Cost: $2.5 billion, strengthening China-Pakistan ties.

- Collaborate on KAAN: Partnering with Turkey on the KAAN fifth-generation fighter, already in progress, provides a future stealth option. Co-development costs ($1–2 billion) are viable with Chinese backing.

Conclusion

The F-35, Su-57, and J-35 represent distinct approaches to fifth-generation stealth, each with trade-offs for India and Pakistan. For instance, the F-35’s superior stealth and avionics come with prohibitive costs and geopolitical constraints, making it a distant prospect for both. The Su-57, affordable and aligned with India’s Russian ties, offers source code access but suffers from production and reliability issues. The J-35, Pakistan’s likely choice, balances cost and capability but lacks operational maturity. Consequently, India should expand Rafales and Tejas while accelerating AMCA, while Pakistan should upgrade JF-17s and procure J-10Cs, with KAAN as a long-term goal. Both nations must prioritise fiscal prudence and strategic autonomy to counter regional threats effectively.