(By Khalid Masood)

On 21 June 2025, the United States, in a reckless act of aggression, launched B-2 Spirit stealth bombers and Tomahawk missiles against Iran’s nuclear facilities at Fordow, Natanz, and Isfahan, killing 24 scientists and wounding scores, according to Iran’s Tasnim News. This unprovoked assault, following Israel’s strikes and escalating tensions in the ongoing Iran–Iraq conflict, has pushed the Islamic Republic to the brink. In a fiery response, Iran’s Islamic Revolutionary Guard Corps (IRGC) vowed to close the Strait of Hormuz, the world’s most vital oil chokepoint, through which 20% of global oil flows. Iran’s Supreme Leader Ayatollah Ali Khamenei, addressing a Tehran rally, declared, “Our enemies will face irreparable consequences,” as parliament voted on 22 June to block the strait, pending Supreme National Security Council approval. This bold threat, rooted in Iran’s sovereign right to defend itself, could reshape global trade, challenge US naval dominance, and plunge Pakistan into an energy crisis. This article explores the Strait of Hormuz’s strategic geography, its critical role in global shipping, the catastrophic impact of a blockade, Iran’s means to enforce it, the US’s response options, and the dire consequences for Pakistan, a nation caught in the crossfire of Western hubris and Iranian resilience.

I. The Strait of Hormuz: The World’s Energy Lifeline

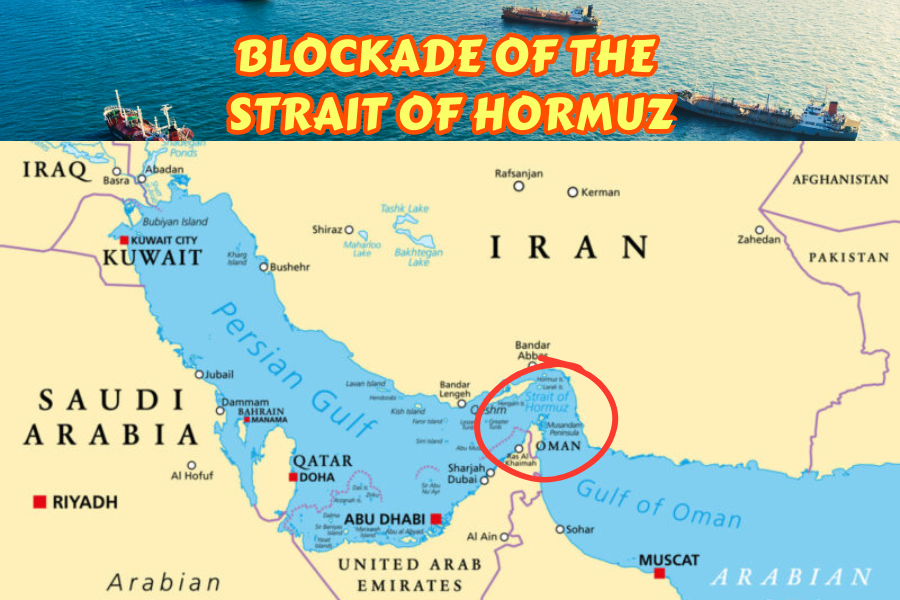

Nestled between Iran’s rugged northern coast and the Musandam Peninsula of Oman and the UAE to the south, the Strait of Hormuz is a narrow maritime corridor connecting the Persian Gulf to the Gulf of Oman and the Arabian Sea beyond. Spanning 167 km in length and narrowing to just 33 km at its tightest point, the strait’s two 3-km-wide shipping lanes—one inbound, one outbound—form a precarious artery for global trade. According to the US Energy Information Administration (EIA), 20 million barrels per day (b/d) of crude oil and petroleum products, equating to 20% of global oil consumption and 25% of seaborne oil trade, traversed the strait in 2024 and Q1 2025. Additionally, one-fifth of global liquefied natural gas (LNG), primarily from Qatar, flows through this chokepoint, with 3,000 ships monthly navigating its waters.

- Geographic Significance: The strait’s shallow waters, deepest near Oman’s Musandam Peninsula at over 650 feet, accommodate the world’s largest supertankers. Iran controls seven of the strait’s eight strategic islands, including Abu Musa and the Tunbs, contested with the UAE, granting Tehran significant influence over maritime traffic.

- Traffic Flow: Saudi Arabia leads exports through the strait, contributing 5.5 million b/d (38% of crude flows), followed by Iran, UAE, Kuwait, and Iraq. Major importers include China (31% of crude flows), India (22%), Japan, and South Korea, with 69% of Hormuz oil destined for Asia.

- Historical Context: Named the Persian Gulf for centuries after the Persian Empire, the strait has been a trade hub since antiquity, carrying luxury goods like almonds from Ferghana to global markets, as noted in Babur’s memoirs.

Iran’s threat to close this vital waterway, through which a third of the world’s LNG and 25% of oil consumption passes, is a defiant stand against Western aggression, leveraging its geographic advantage to challenge global economic stability.

II. Iran’s Threat: A Response to Imperial Provocation

Iran’s vow to block the Strait of Hormuz is not mere rhetoric but a calculated response to the US’s illegal strikes and the rekindled Iran–Iraq conflict, which has seen Iraq, under US influence, resume hostilities against Tehran. On 22 June, Iran’s parliament approved a measure to close the strait, with IRGC Navy Commander Brigadier General Alireza Tangsiri warning it could be shut “within hours.” This threat, endorsed by senior lawmaker Esmail Kosari, reflects Iran’s resolve to retaliate against what Foreign Minister Abbas Araghchi called a “flagrant violation” of the UN Charter and the Nuclear Non-Proliferation Treaty (NPT).

- Strategic Context: Iran has long used the strait as leverage, threatening closure during tensions like the 2011–2012 US sanctions and the 1980s Iran–Iraq War’s Tanker War, when both sides attacked ships without fully halting traffic. The 2025 escalation, driven by US and Israeli strikes, marks a new threshold, with Iran’s leadership viewing the strait as a “sword of Damocles” over global markets.

- Diplomatic Fallout: Iran’s allies, Russia and China, condemned the US strikes, with Moscow’s Dmitry Medvedev warning of economic chaos and Beijing urging restraint to protect its 90% share of Iran’s oil exports. US Secretary of State Marco Rubio’s plea for China to dissuade Iran underscores Tehran’s diplomatic clout, as closing the strait would harm Beijing’s energy security.

Iran’s threat is a cry of sovereignty, a nation battered by sanctions, assassinations, and now direct attacks, wielding its geographic trump card to demand respect on the world stage.

III. Impact of a Blockade: A Global Economic Earthquake

A blockade of the Strait of Hormuz would be a cataclysm for global energy markets, disrupting 20 million b/d of oil and 25% of LNG flows, with ripple effects devastating economies, particularly in Asia and Europe, and severely impacting Pakistan.

- Energy Markets: Energy experts predict oil prices could soar to $150–$200 per barrel, surpassing the 2008 peak of $147, with a 30–50% spike in gas prices. This would trigger global inflation, raising costs for households, industries, and transport. Europe, reliant on Qatari LNG, and Asia, with China and India importing 53% of Hormuz oil, would face severe shortages.

- Global Trade: The strait’s closure would halt container traffic to Dubai’s Jebel Ali port, a transshipment hub for South Asia and East Africa, disrupting supply chains for goods beyond energy. Shipping reroutes around Africa’s Cape of Good Hope, as seen in 2024’s Red Sea crisis, would add $200 billion in annual costs.

- Regional Instability: A blockade would draw Gulf states, aligned with the US, into conflict, risking a broader war involving NATO and Asian powers. Iran’s own exports (1.5 million b/d) would suffer, but its resilience under sanctions suggests it could endure short-term losses to inflict global pain.

The world, addicted to Persian Gulf oil, would reel from Iran’s bold gambit, a testament to its power to hold global economies hostage in defense of its sovereignty.

IV. Can Iran Block the Strait? Conventional and Unconventional Means

Iran’s ability to disrupt the Strait of Hormuz is formidable, leveraging its asymmetric warfare capabilities honed over decades. While a total closure is challenging due to the strait’s width and Oman’s control of its southern waters, Iran can render the waterway too dangerous for commercial traffic.

Conventional Means

- Naval Mines: Iran possesses 6,000–10,000 naval mines, including advanced EM-52 models, deployable by IRGC speedboats or submarines. Mines laid across the strait’s 33-km narrow point could sink tankers or deter passage, as seen in the 1980s Tanker War, which raised insurance premiums by 25%.

- Anti-Ship Missiles: Iran’s arsenal includes Noor and Qader cruise missiles (200–300 km range) and Khalij-e-Fars anti-ship ballistic missiles (ASBMs), capable of targeting tankers or US warships. The IRGC Navy’s 1,500 fast-attack boats can launch these from coastal sites or islands like Qeshm.

- Warships and Submarines: Iran’s navy, with bases at Bandar Abbas and Chah Bahar, deploys frigates and Kilo-class submarines to harass or seize vessels, as in the 2024 MSC Aries incident.

Unconventional Means

- Drone Swarms: Iran’s Shahed-136 and Shahed-149 drones, with ranges up to 2,500 km, can strike tankers or infrastructure like Saudi’s Abqaiq facility, as demonstrated by Houthi attacks in 2019.

- Cyberattacks: Iran’s 2012 Shamoon attack on Saudi Aramco showcases its cyber prowess, which could disrupt tanker navigation or port operations.

- Proxy Attacks: Iran could enlist Yemen’s Houthis, who disrupted Red Sea shipping in 2024 with ASBMs and drones, to target Hormuz-bound vessels, amplifying chaos without direct attribution.

A 2008 Strauss Center report estimated a 5–12% chance of stopping individual tankers with small boat or missile attacks, but sustained disruption could collapse traffic, as seen in the Red Sea’s 75% traffic drop in 2024. Iran’s control of strategic islands and coastal batteries, per OpIndia, gives it a tactical edge, though Oman’s neutrality and US naval presence complicate a full blockade. Iran’s ingenuity, born of necessity under sanctions, makes its threat credible, a defiant challenge to Western dominance.

V. US Response: Can the Fifth Fleet Prevail?

The US, with its Fifth Fleet in Bahrain, is tasked with ensuring freedom of navigation, but reopening a blocked Strait of Hormuz would be no “cakewalk,” as Rapidan Energy’s Bob McNally warned.

- Military Assets: The Fifth Fleet deploys Arleigh Burke-class destroyers with Aegis systems, F-35 and F-16 fighters, and the USS Bataan Amphibious Group, reinforced after Iran’s 2024 vessel seizures. Mine-countermeasure ships and P-8 Poseidon aircraft can detect and clear mines, but clearing thousands could take weeks, per CSIS.

- Counter-Strategies: The US could launch airstrikes on IRGC bases or coastal missile sites, as in March 2025 against Houthi targets, but risks escalating to full-scale war. Cyber defenses and satellite surveillance could counter Iran’s cyberattacks and drones, though swarm tactics strain Aegis systems, as seen in Red Sea engagements.

- Challenges: Iran’s asymmetric tactics—mines, speedboats, and proxies—exploit the strait’s narrowness, where a single sunken tanker could halt traffic. The 2002 Millennium Challenge wargame showed Iran’s swarm tactics overwhelming US forces, sinking 16 ships in simulations. A prolonged blockade could last weeks, spiking oil prices to $130, per TD Securities.

The US Navy, though formidable, faces a resilient adversary in Iran, whose low-cost, high-impact tactics could prolong disruption, exposing the limits of American power against a determined foe.

VI. Pakistan’s Precarious Position

Pakistan, a neighbor to Iran and a key player in South Asia, faces dire consequences from a Strait of Hormuz blockade, given its reliance on Gulf energy imports and delicate diplomatic balancing act.

- Energy Crisis: Pakistan imports 80% of its crude oil (400,000 b/d) and 50% of its LNG from the Gulf, primarily Qatar and Saudi Arabia, via the strait. A blockade could spike oil prices to $150, increasing Pakistan’s import bill by $5–7 billion annually, per estimates based on India’s vulnerability. With inflation already at 12% in 2025, per Trading Economics, fuel price hikes would cripple households, transport, and industries, risking economic collapse.

- Trade Disruptions: Karachi and Gwadar ports, handling 60% of Pakistan’s trade, rely on Hormuz routes for Gulf-bound cargo. Rerouting via Africa would add 15–20 days and $200,000 per ship in costs, per BIMCO, strangling Pakistan’s textile exports, which account for 55% of foreign exchange earnings.

- Diplomatic Dilemma: Pakistan’s close ties with Iran, cemented by the 2024 Chabahar port agreement, clash with its reliance on Saudi and US aid. A blockade would pressure Islamabad to align with the US, risking Iran’s ire and stalling Chabahar, a counterweight to China’s Gwadar port. Foreign Minister Ishaq Dar’s call for “de-escalation” on 22 June reflects Pakistan’s tightrope walk.

- Security Risks: A regional war could embolden Baloch insurgents, supported by Iran in past tensions, to target Gwadar, while Houthi attacks on Gulf shipping could spill into Pakistani waters, as seen in 2024’s Red Sea crisis.

Pakistan, already reeling from economic woes, faces a nightmare scenario, its energy lifeline severed by Western aggression and Iran’s desperate retaliation.

VII. Conclusion: Iran’s Righteous Defiance

Iran’s threat to block the Strait of Hormuz is a thunderous cry against US and Israeli aggression, a nation pushed to its limits wielding its geographic might. The strait, a 33-km-wide lifeline carrying 20% of the world’s oil, is Iran’s trump card, its closure a potential earthquake for global markets. With mines, missiles, drones, and proxies, Iran can disrupt—if not fully close—the strait, rendering it a gauntlet of danger for tankers. The US Fifth Fleet, though powerful, faces a grueling fight against Iran’s asymmetric prowess, risking weeks of disruption and oil prices soaring to $200. Pakistan, tethered to Gulf energy, would face economic ruin, its people bearing the brunt of Western folly.

Yet Iran’s defiance is not reckless but righteous, a stand for sovereignty against a history of sanctions, sabotage, and strikes. The world, from China to Europe, would suffer, but Iran’s pain—its scientists martyred, its facilities bombed—demands action. Diplomacy, not war, is the path forward, but the US’s arrogance has slammed that door. As tankers U-turn from the strait, per Spencer Hakimian’s X post, the world holds its breath. Iran, unbowed, stands ready to reshape history, its resolve a beacon for those who resist imperial might. Let the West heed this warning, lest the Persian Gulf burns.