Introduction

In April 2025, the Pahalgam attack in Indian Occupied Kashmir triggered a sharp escalation in tensions between India and Pakistan. While India blamed Pakistan for the attack—without conclusive evidence—its response quickly spiraled into a broader diplomatic and economic confrontation. What was initially a bilateral crisis took on a regional dimension as Turkey and Azerbaijan openly sided with Pakistan, reaffirming their longstanding ties rooted in religion, history, and strategic cooperation.

India retaliated with a sweeping economic boycott of Turkish and Azerbaijani goods and services. This action was promptly countered by similar boycotts from Turkey, Azerbaijan, and surprisingly, Bangladesh—a traditional Indian ally whose recent disenchantment with Delhi’s regional posture became evident.

This article offers a comprehensive analysis of the trade and tourism losses incurred by all parties involved and explains the evolving geopolitical alignments through a Pakistani lens.

1. Strategic Importance of Turkish and Azerbaijani Support to Pakistan

The backing of Turkey and Azerbaijan in times of diplomatic tension with India is not accidental. These nations have cemented their trilateral alliance with Pakistan over recent years through military exercises, defence cooperation, and cultural solidarity. Turkey, under President Erdoğan, has consistently raised the Kashmir issue in international forums. Azerbaijan, fresh from its military success in the Nagorno-Karabakh conflict, sees Pakistan as a key ally against Armenian and Indian support networks.

In May 2025, both nations voiced firm support for Pakistan’s stance on Kashmir, sparking widespread condemnation in Indian media. The Indian government, under domestic pressure, initiated boycotts that sought to economically punish both countries.

2. What India Stands to Lose: Turkish and Azerbaijani Contributions to Indian Economy

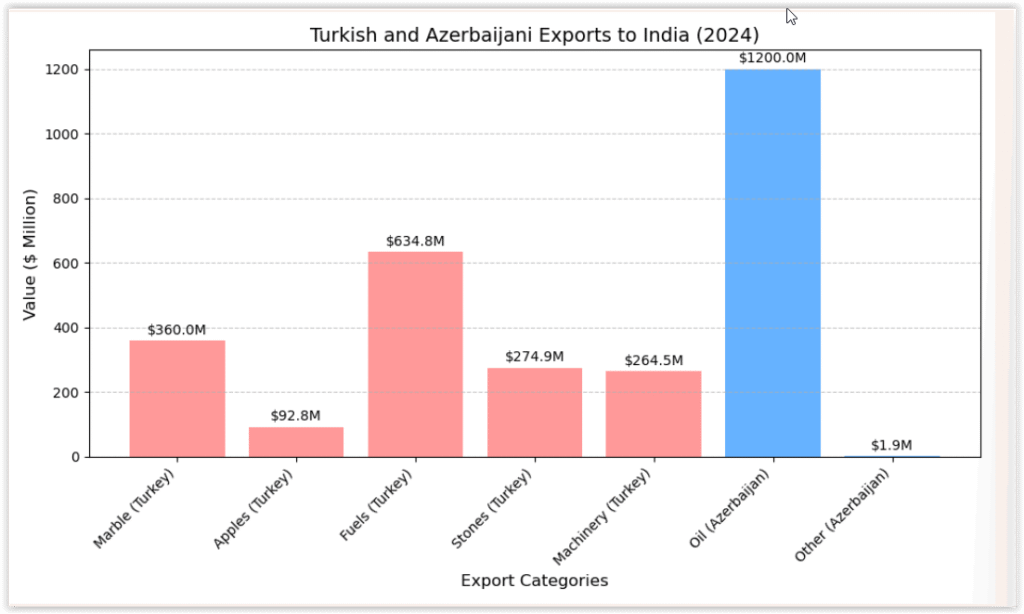

a. Turkish Exports to India

India and Turkey’s bilateral trade reached $10.43 billion in FY 2023–24. Turkish goods and services used widely across Indian industries include:

- Marble and Stone: Over 70% of India’s imported marble—used in real estate and religious architecture—comes from Turkey, valued at $300–360 million annually.

- Food Products: Turkish apples, chocolates, teas, nuts, and olive oil are popular among India’s urban elite. Apple imports alone touched nearly $93 million in 2023.

- Industrial Machinery: Imports of nearly $264.5 million worth of Turkish machinery support India’s manufacturing sector.

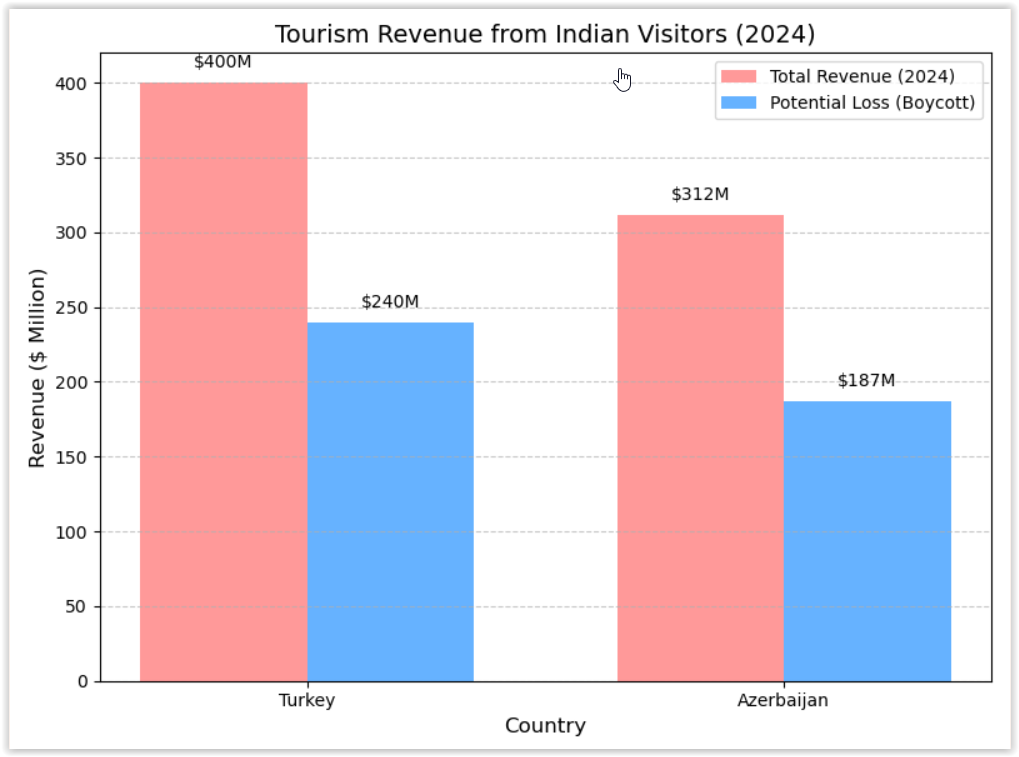

- Tourism: In 2024, over 330,000 Indian tourists visited Turkey, spending $291–400 million. This makes India one of Turkey’s emerging tourism markets, especially for high-end weddings and cultural tours.

- Services: Turkish Airlines and Çelebi Aviation had extensive partnerships in India before May 2025. These included codeshare agreements and airport ground handling operations at major Indian airports like Delhi and Mumbai.

b. Azerbaijani Exports to India

Though smaller, Azerbaijan’s $1.43 billion trade with India includes critical items:

- Crude Oil: A key strategic export, making up a large portion of India’s energy imports from Azerbaijan.

- Tourism: Around 243,000 Indian tourists visited Azerbaijan in 2024, spending up to $312 million. The country has become a budget-friendly alternative to Europe and Dubai for Indian travelers.

- Consumer Goods: Azerbaijani tea, juices, textiles, and dry fruits are gaining popularity in India’s premium retail space.

3. Impact of Indian Boycott on Turkey and Azerbaijan

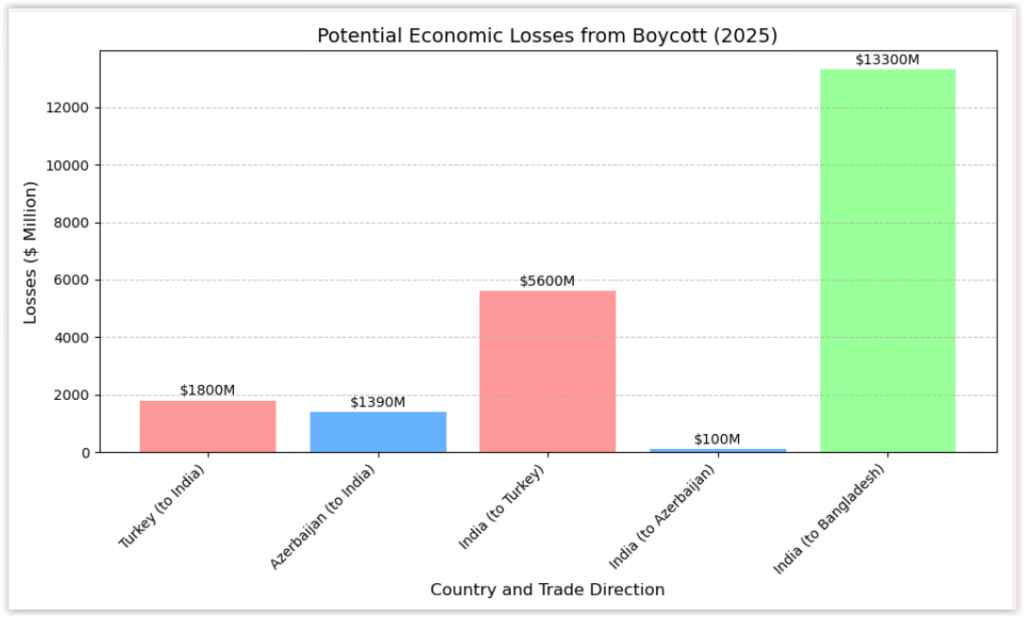

Turkey

- Trade Losses: India’s boycott of Turkish goods may cost Turkey between $1.2–1.3 billion annually.

- Tourism: Expected losses in 2025 could reach up to $240 million as travel bookings plummet and Indian weddings in Turkey are canceled.

- Aviation and Services: Çelebi Aviation’s exit and reduced bookings for Turkish Airlines may cause service sector losses of up to $50 million.

Total Estimated Losses for Turkey: $1.4–1.8 billion annually

Azerbaijan

- Trade: With a boycott of crude oil exports and consumer goods, losses could exceed $1–1.2 billion.

- Tourism: Projected losses range from $40–187 million due to canceled Indian trips and events.

- Medical Tourism: Azerbaijan has been emerging as a healthcare destination for Indian patients. This industry will face revenue dips.

Total Estimated Losses for Azerbaijan: $1.04–1.39 billion annually

4. The Counter-Boycott: India’s Losses in Turkey, Azerbaijan, and Bangladesh

In retaliation, citizens and trade unions in Turkey and Azerbaijan called for a boycott of Indian goods and services. Bangladesh, too, surprised observers by issuing statements of solidarity with its Muslim allies, igniting a counter-boycott movement.

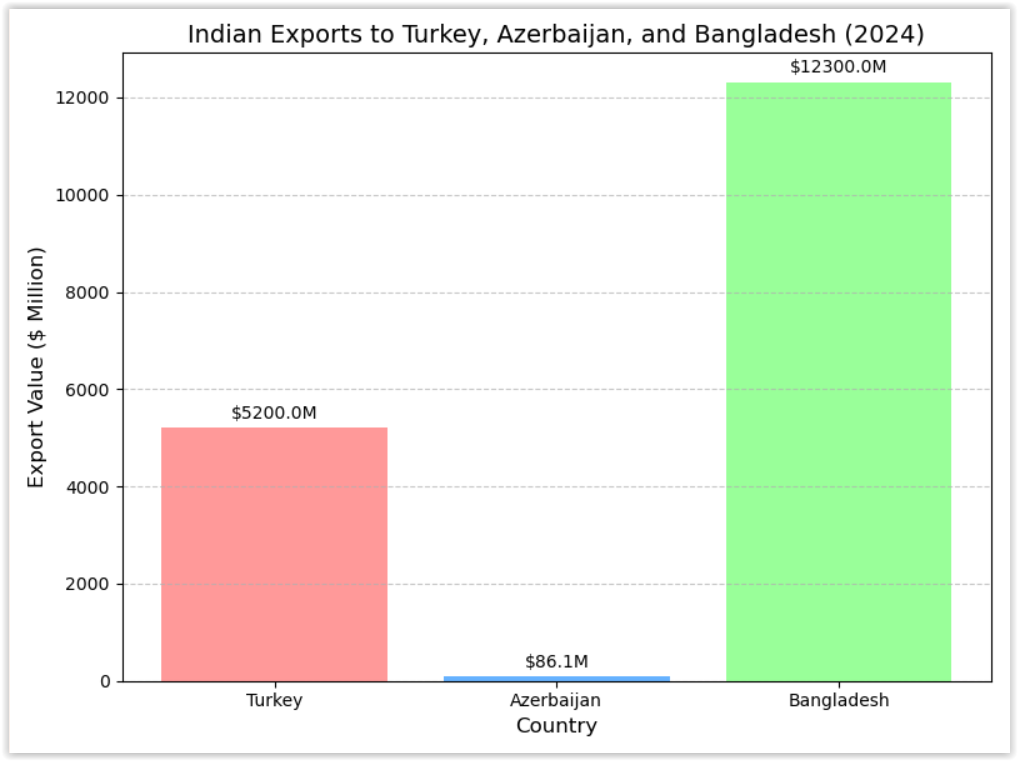

a. Indian Exports to Turkey

India exported over $5.2 billion to Turkey in the last fiscal year. Key sectors affected:

- Refined Petroleum and Steel

- Pharmaceuticals

- Textiles and Electronics

A boycott could cost India up to $5.5 billion annually, significantly impacting exporters in Maharashtra, Gujarat, and Tamil Nadu.

b. Indian Exports to Azerbaijan

Totaling $86 million, the most affected sectors are:

- Pharmaceuticals

- Tobacco and Food Items

- Machinery and Electronics

Estimated Loss: $85–100 million

c. Indian Exports to Bangladesh

Bangladesh is one of India’s top trading partners with exports reaching $12.3 billion in FY 2023–24. Sectors most affected:

- Cotton & Textiles (key to Bangladesh’s garment industry)

- Vehicles & Machinery

- Cereals and Fuel

- Pharmaceuticals and Medical Equipment

Total Estimated Losses: $12.2–13.3 billion

Combined Impact of Boycott on India: $17.34–19 billion annually

This amounts to 4–4.4% of India’s total exports ($437 billion), a notable blow amidst slowing global trade and rising inflation.

5. The Changing Geo-Economic Landscape: Lessons for Pakistan

From a Pakistani vantage point, the 2025 crisis highlights several key trends:

- Strengthening Muslim Bloc: Turkey, Azerbaijan, and Bangladesh’s support demonstrates the power of shared values and historical ties in modern diplomacy.

- India’s Isolation Tactics Are Risky: Boycotts that seek to punish smaller nations often backfire by uniting them and driving them toward alternative alliances.

- Economic Interdependence Cuts Both Ways: India’s loss of $17+ billion in export markets indicates that retaliatory diplomacy carries real economic costs.

- Pakistan’s Diplomacy Pays Off: Islamabad’s long-term investment in strengthening ties with Turkey and Azerbaijan has yielded diplomatic dividends.

Conclusion

The post-Pahalgam 2025 regional fallout may be remembered not for the terror attack that triggered it—but for the realignment it caused in South Asian and Middle Eastern diplomacy. Turkey, Azerbaijan, and Bangladesh’s siding with Pakistan underscores a shift in regional loyalties and highlights the diminishing impact of India’s traditional soft power in neighboring Muslim nations.

The economic boycott and counter-boycott strategies reveal just how deeply global economies are intertwined. For Pakistan, this moment is an opportunity to not only solidify regional partnerships but also present itself as a responsible player advocating for peace and justice in Kashmir and beyond.